Learn about the foundations of the long-term financing tools in the budget manual

On this page

Reserves and reserve funds

The City uses reserves and reserve funds for planned capital expenses, strategic objectives, unexpected or extraordinary costs, and to minimize the impact of fluctuations in the operating and capital budgets on the tax levy. They also allow for informal inter-reserve borrowing, which helps the City manage debt levels.

The City’s reserves and reserve funds are classified as either obligatory or discretionary. Obligatory reserve funds are created when a provincial statute requires that revenue received for specific purposes is segregated from the general revenues of the municipality. Obligatory reserve funds are to be used solely for the purpose prescribed for them by statute. Discretionary reserve funds are created under the Municipal Act when Council wishes to earmark revenue to finance a future expenditure for which it has the authority to spend money, and to set aside a certain portion of any year’s revenues so that the funds are available as required.

The City currently has over 80 reserves and reserve funds. A long-term forecast for each of the reserves and reserve funds has been prepared as part of the 2025 confirmed budget. This long-term view helps the City understand the flexibility and sustainability of the plan and affordability of the operating and capital budget and forecasts over the long term. The forecast incorporates planned transfers identified under the various funding strategies, any known external grants received, as well as the planned capital and operating expenditures.

Ideally, the reserve balances remain positive over the entire forecast, and meet the target balances and annual transfer levels as outlined in the Reserve and Reserve Fund Policy, indicating the plans are affordable and sustainable. The capital reserve forecast included in the 2025 confirmed budget achieves the objective of an overall positive balance, after commitments, by 2034. However, the minimum reserve balance targets specified in the current policy will not be achieved with the current plan. This policy is scheduled to be reviewed in 2025, after which staff may recommend updates to target minimum balances for Council approval. This work will lay the foundation for future capital funding discussions as part of the next multi-year budget (MYB) cycle.

The tax-supported corporate contingency reserve balance targets to have 8 – 10 per cent of annual combined operating revenue on hand. These reserves help to mitigate unexpected impacts, and phase-in unexpected or significant cost increases that cannot be avoided. This group of reserves were drawn upon quite significantly throughout the MYB, and continue to be in the 2025 confirmed budget. The balance in this group of reserves is expected to range from from 19 per cent to 28 per cent of the target from 2025 through 2028. Staff have continued to recommend through the Budget Companion Report that future tax-supported operating surpluses be directed to restoring contingency reserve balances to reduce the City’s vulnerability to unexpected events. Notable changes to the contingency reserve forecast from the MYB include:

- A change in the approach to phasing in the County Social Services 2024 budget increase, from under-budgeting each year in the operating budget until the increase is fully phased in in 2027 to budgeting for the full amount of the County’s budget and funding the phase-in from Tax Operating Contingency reserve (180). Total costs of $4.3 million over 2025 and 2026 are projected to be supported through the reserve.

- A change in the approach to budgeting for higher-than-normal investment income, from underbudgeting for investment income with an expected surplus while short-term investment returns remain higher than 2.00 per cent to budgeting for the expected level of investment returns based on interest rate forecasts, with an offsetting transfer to Tax Operating Contingency reserve (180). Total revenue of $1.7 million over 2025 to 2027 is projected to support the reserve.

- Funding two new pilot projects for Guelph Transit for $174 thousand in 2025:

- Youth ride free weekdays after 5 p.m. and all day on weekends and holidays

- Seniors ride free one day per week

- Funding an unexpected streetlighting utility rate increase from Alectra Utilities for $480 thousand. The City was made aware that Alectra has applied a rate correction resulting from the lower revenues they have received since the City implemented energy efficient LED lights. The rate correction will continue until electricity rates are reclassified in 2028. Alectra has the authorization to do this through the Independent Electricity System Operator. Total costs of $720 thousand over 2025 and 2026 are projected to be supported through the Environment and Utility Reserve (198) as the City phases in this budget increase.

- Funding additional Corporate Building Maintenance costs as cost pressures continue to be experienced in this area. Total costs of $494 thousand over 2025 and 2026 are projected to be supported through the Tax Operating Contingency Reserve (180) as the City phases in this budget increase.

- The contingency reserve funding for the Bicentennial enhancement events planned in 2025-2027, at a total commitment of $905 thousand, has been removed from the confirmed budget due to the operating contingency reserves funding status.

- The inclusion of a reserve allocation of $1.7 million for the projected 2024 tax-supported operating budget surplus as reported in the Third Quarter Budget Monitoring Report.

- The inclusion of a reserve allocation of $500 thousand for any additional paramedics costs associated with the closure of Consumption and Treatment Services Sites. This is a preliminary earmark of contingency reserve capacity as the financial impacts of this change are currently unknown.

- Tax operating contingency reserve (180) funding of $100 thousand for providing a resource to expand sponsorships and identify potential corporate partnerships.

- Funding of the hospital levy for 2025 in the amount of $750 thousand from the contingency reserve.

The largest impact to the reserve and reserve fund forecast in the 2025 confirmed budget is the capital budget prioritization. A total of $1.1 billion of capital work was deferred out of the capital budget and forecast from 2025-2034. The results of this prioritization are reflected in the forecast in Table 77. The most significant impacts can be seen in the tax-supported corporate capital, non-tax supported capital and DC reserve funds. The funding of these reserve funds is discussed in the Long-term Financial Tools overview section, and the impacts of the capital budget prioritization are discussed in the Capital Budget section.

Tax-supported corporate capital is projected to be in a deficit position until 2034, which is a concern as this is the main source of funds from which unexpected capital costs would be supported. The deficit position also provides less flexibility to adapt to new opportunities, like grants with a matching City portion. However, there is space to adjust the capital plan through future annual budget updates as needed. This will never be a static plan, and staff will continue to be responsive and engage with Council with each budget update.

Another area to monitor is the overall reserve and reserve fund balances in 2027. The total projected balance of the reserves and reserve funds is $34.9 million in 2027. For comparison, the uncommitted 2024 balance is forecast to be $235.4 million. This reduction in reserve and reserve fund balances demonstrates the significant amount of work that is proposed to be completed through the capital budget from 2025 to 2027. It is also important to note that capital projects are fully budgeted in the year that the capital project is expected to be tendered, and therefore, capital reserve funding is committed in that year. The reserve fund projects do not represent a cash flow forecast; they indicate a commitment of funding. Cash flow related to major projects normally happens over multiple years. Going into the next multi-year budget cycle in 2028, there will likely be an emphasis on increasing the capital reserve fund transfers to ensure long-term financial sustainability and reduce vulnerability to unexpected events.

The balances of the tax-supported capital, non-tax supported capital, capital obligatory reserve funds and development charge (DC) reserve funds is a combined $6.2 million deficit in 2027, which returns to a positive position in 2028. Therefore, to add new projects to the capital budget, an equivalent value project must be removed from the 2025 to 2027 period, or additional tax-supported capital funding must be provided.

Overall, the updated reserve forecast meets the direction from Council for a balanced capital reserve fund forecast, and actual balances will be closely monitored through annual budget and reporting processes.

| Reserve Fund Grouping | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Tax-supported corporate capital reserve funds | (7.0) | (11.5) | (27.3) | (31.0) | (41.6) | (48.1) | (44.7) | (39.4) | (35.0) | (24.4) | 12.3 |

| Non-tax supported capital reserve funds | 103.7 | 109.4 | 59.5 | 23.0 | 20.7 | 29.8 | 30.7 | 65.3 | 37.5 | 75.5 | 152.0 |

| Capital obligatory corporate reserve funds | 47.5 | 43.6 | 39.6 | 22.7 | 25.2 | 31.5 | 36.9 | 12.7 | 14.1 | 19.2 | 21.2 |

| Development charge reserve funds (after debt) | 33.7 | 67.5 | (1.1) | (20.9) | 2.3 | 43.4 | 81.4 | 97.4 | 60.2 | 104.5 | 117.1 |

| Total capital reserve funds | 177.9 | 210.0 | 70.7 | (6.2) | 6.6 | 56.6 | 104.3 | 136.0 | 76.8 | 174.7 | 302.6 |

| Tax-supported corporate contingency reserves | 19.8 | 13.8 | 11.3 | 11.3 | 11.1 | 11.1 | 11.1 | 11.1 | 11.1 | 11.1 | 11.1 |

| Non-tax supported contingency reserves | 5.9 | 3.3 | 3.7 | 4.1 | 4.5 | 4.6 | 4.8 | 5.0 | 5.2 | 5.3 | 5.5 |

| Total contingency reserves | 25.7 | 17.1 | 15.1 | 15.5 | 15.5 | 15.7 | 15.9 | 16.0 | 16.2 | 16.4 | 16.6 |

| Tax-supported program-specific reserves | 17.8 | 17.8 | 17.1 | 17.3 | 17.5 | 18.1 | 18.7 | 19.4 | 20.0 | 20.6 | 21.2 |

| Tax-supported strategic reserves | 2.8 | (4.2) | (5.1) | (5.8) | (5.5) | (4.8) | (3.7) | (2.3) | (0.4) | (1.5) | (2.2) |

| Tax-supported program- specific reserve funds | 8.4 | 9.4 | 8.8 | 7.7 | 7.3 | 8.2 | 8.0 | 9.8 | 11.3 | 10.2 | 11.2 |

| Other obligatory corporate reserve funds | 6.1 | 6.2 | 6.5 | 6.5 | 6.5 | 6.5 | 6.5 | 6.5 | 6.5 | 6.5 | 6.5 |

| Total other reserve and reserve funds | 35.0 | 29.2 | 27.3 | 25.7 | 25.8 | 28.0 | 29.6 | 33.4 | 37.4 | 38.8 | 41.2 |

| Total reserve and reserve fund balances | 238.6 | 256.3 | 113.1 | 34.9 | 47.9 | 100.3 | 149.7 | 185.5 | 130.5 | 229.9 | 360.3 |

| Adopted budget balances | 178.3 | 167.5 | 64.3 | (103.9) | (278.3) | (298.1) | (327.3) | (422.6) | (400.4) | (331.0) | (492.2) |

| Change in balance through 2025 Budget Update | 60.3 | 88.8 | 48.8 | 138.8 | 326.2 | 398.4 | 477.0 | 608,1 | 530.9 | 560.9 | 852,5 |

Actual reserve and reserve fund activity and year-end balances for all reserves and reserve funds, along with detailed comparison of the balance relative to the target balance, are provided to Council in the second quarter of each year.

Debt strategy

Staff estimate the City will be able to borrow a maximum of $50 million in new debt in any year, based upon brokerage advice on capacity of the market to invest in City bonds in any given year. The analysis and proposals discussed below have been developed based on the estimated $50 million annual borrowing limit. The debt forecast was developed based on a 20-year debt term at 4.5 per cent interest, reflective of current market conditions. The true limit, term, and interest rate will change as the market and economic environment change. The City will need to revisit these assumptions prior to borrowing.

Debt continues to be planned for a mix of previously approved capital projects, debt refinancing, and proposed capital projects included in the current capital budget and forecast that meet the requirements in the Debt Management Policy. There is also debt reserved for DC funded infrastructure which is not assigned to capital projects at this time.

New debt issuances will be prioritized for capital projects approved in previous budgets with debt financing, as well as refinancing the balloon payment for Bylaw (2016) – 20084 in 2026. Table 78 shows how the new debt will be divided among refinancing existing debt, issuing debt approved by Council in previous budgets, and debt contained in this capital budget and forecast. It should be noted that this will be monitored, and the timing of borrowing may change depending on actual project activity and cash flow availability over the forecast period.

| Description | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 |

|---|---|---|---|---|---|---|---|---|---|---|

| Refinance of existing debt | 0.0 | 26.2 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Debt financing for projects approved through 2024 and previous budgets | 50.0 | 23.8 | 50.0 | 22.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Debt financing for projects included in 2025 and future budgets per the 2025 confirmed budget | 0.0 | 0.0 | 0.0 | 27.9 | 50.0 | 15.7 | 0.0 | 0.0 | 0.0 | 0.0 |

| Debt capacity reserved for growth projects | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 34.3 | 50.0 | 50.0 | 50.0 | 50.0 |

| Total borrowing | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 |

Through the capital budget prioritization process, the timing of some projects that had debt planned in the 2024-2027 multi-year budget and forecast changed. The debt capacity was reallocated to projects with more optimal timing for debt issuance, but the overall level of debt planned over the coming decade has not changed.

Table 79 lists the previously approved projects with planned debt, which totals $145.9 million of debt unissued debt which totals $145.9 million of debt unissued debt. This has been updated to include a reduction in the debt assigned to the Baker District Redevelopment, for the $13.5 million grant from Green and Inclusive Buildings program, which reduced the planned debt by $9.0 million.

| Description | Capital project number | Timing | Confirmed budget Debt Allocated |

|---|---|---|---|

| South End Community Centre construction | RF0093 | 2025 | 39.4 |

| Baker District Redevelopment projects | LB0028 PG0079 SS0025 | 2025 to 2027 | 53.8 |

| FM Woods Station upgrade | WT0064 | 2027 to 2028 | 45.2 |

| Guelph Transit and Fleet Services Facility | TC0059 | 2028 | 7.5 |

| Total | n/a | n/a | 145.9 |

Table 80 lists the planned debt assigned to project costs budgeted in the updated 2025 10-year capital budget and forecast. These projects meet the criteria in the Debt Management Policy and were strategically selected to reduce pressure on the tax supported capital reserve funds. By assigning debt as proposed, the City can advance more work through the capital budget and achieve a balanced capital reserve fund forecast by 2034 for tax supported capital.

| Description | Capital project number | Timing | Amount |

|---|---|---|---|

| FM Woods Station upgrade | WT0064 | 2028 | 6.1 |

| Guelph Transit and Fleet Services – Transit Facility | TC0059 | 2028 | 17.0 |

| Downtown Renewal Streetscaping Enhancements | PN0041 PN0048 PN0060 PN0798 PN0811 PN0893 | 2028 to 2029 | 17.1 |

| Material Recovery Facility Retrofit for Collections Operations | WC0046 | 2029 | 6.8 |

| Riverside Park Facility Renovation and Expansion | PO0059 | 2029 | 15.6 |

| Operations Administration Renovation and Expansion | GG0267 | 2029 to 2030 | 31.0 |

| Debt capacity reserved for growth projects | n/a | 2030 to 2034 | 234.3 |

| Total | n/a | n/a | 327.9 |

The table includes $234.3 million of debt that is not attached to specific projects at this time but is earmarked in the City’s overall debt capacity for growth projects. If development charge collection does not occur as forecast, there will be increased pressure on development charges reserve funds, and debt will be required to fund the timing difference between growth infrastructure and collections. If the growth infrastructure is built and developers are slow in their development of the lands, the City will have decreased ability to continue funding growth related infrastructure, which could slow growth further.

Borrowing funds asd outlined above will require specific debt-related bylaw approval from Council. A bylaw, along with a staff report containing detailed background information, will be provided to Council before any borrowing is completed.

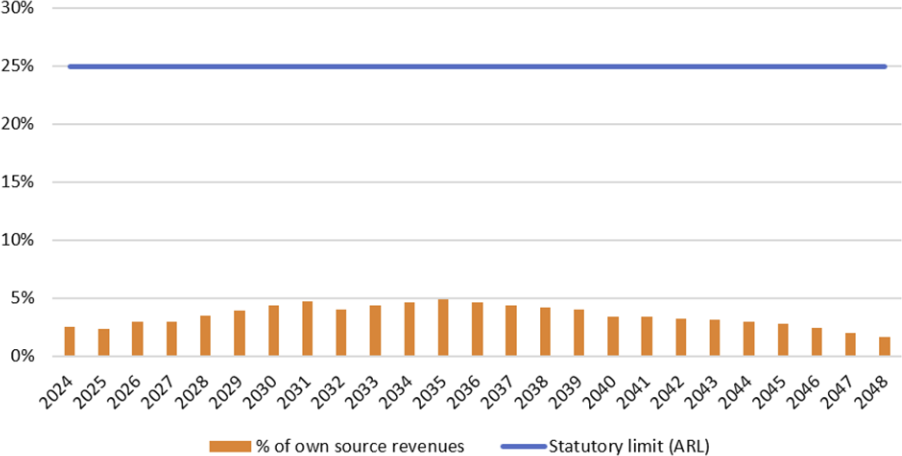

Legislation mandates that municipalities must not borrow if the debt servicing costs exceed 25 per cent of own-source revenues, a threshold known as the Annual Repayment Limit (ARL). In addition to this legislative requirement, the City also has self-imposed limits outlined in the Debt Management Policy.

The City’s planned debt is projected to be within the ARL prescribed by the Province and the limits outlined in the Debt Management Policy shows the City’s estimated debt servicing costs as a percentage of projected own-source revenues, which are well below the ARL.

Figure 8 Debt servicing costs as a percentage of own-source revenue:

View Figure 8 data

| Year | Statutory limit (ARL) | % of own source revenues |

|---|---|---|

| 2024 | 25% | 3% |

| 2025 | 25% | 2% |

| 2026 | 25% | 3% |

| 2027 | 25% | 3% |

| 2028 | 25% | 4% |

| 2029 | 25% | 4% |

| 2030 | 25% | 4% |

| 2031 | 25% | 5% |

| 2032 | 25% | 4% |

| 2033 | 25% | 4% |

| 2034 | 25% | 5% |

| 2035 | 25% | 5% |

| 2036 | 25% | 5% |

| 2037 | 25% | 4% |

| 2038 | 25% | 4% |

| 2039 | 25% | 4% |

| 2040 | 25% | 3% |

| 2041 | 25% | 3% |

| 2042 | 25% | 3% |

| 2043 | 25% | 3% |

| 2044 | 25% | 3% |

| 2045 | 25% | 3% |

| 2046 | 25% | 2% |

| 2047 | 25% | 2% |

| 2048 | 25% | 2% |

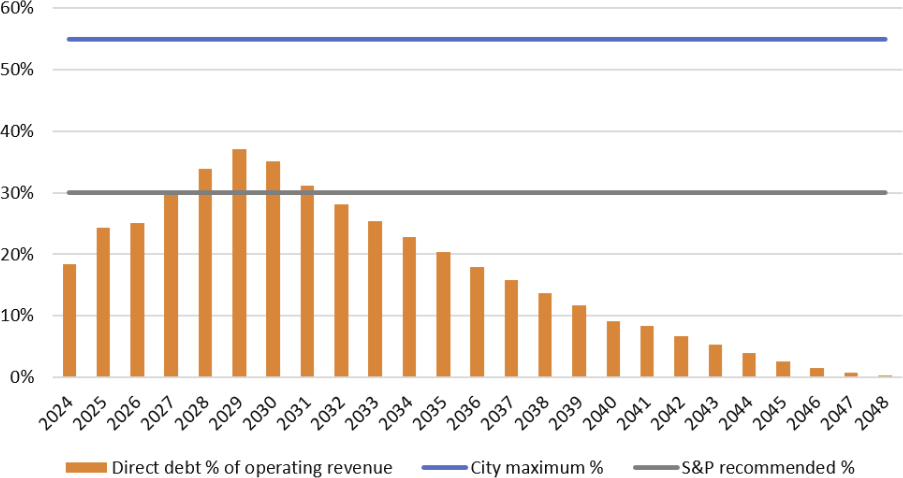

In the projections made for the 10-year forecast, the City’s debt will trend toward the self-imposed policy limits. Figure 9 Projected direct debt to revenue presents the City’s projected debt as a percentage of operating revenue compared to the self-imposed limits and the S&P recommended limit. This figure does not include the debt reserved for growth as there is uncertainty if debt will need to be issued. If this debt is issued, the City would be above the S&P recommended limit for a longer duration, and could approach the policy limits as well. This will be closely monitored through annual budget updates and debt reporting, and updated information based on actual experience will be included in the Council report accompanying any proposed new debt bylaw.

Figure 9 Projected direct debt to operating revenue:

View Figure 9 data

| Year | City maximum % | S&P recommended % | Direct debt % of operating revenue |

|---|---|---|---|

| 2024 | 55% | 30% | 18% |

| 2025 | 55% | 30% | 24% |

| 2026 | 55% | 30% | 25% |

| 2027 | 55% | 30% | 30% |

| 2028 | 55% | 30% | 34% |

| 2029 | 55% | 30% | 37% |

| 2030 | 55% | 30% | 35% |

| 2031 | 55% | 30% | 31% |

| 2032 | 55% | 30% | 28% |

| 2033 | 55% | 30% | 25% |

| 2034 | 55% | 30% | 23% |

| 2035 | 55% | 30% | 20% |

| 2036 | 55% | 30% | 18% |

| 2037 | 55% | 30% | 16% |

| 2038 | 55% | 30% | 14% |

| 2039 | 55% | 30% | 12% |

| 2040 | 55% | 30% | 9% |

| 2041 | 55% | 30% | 8% |

| 2042 | 55% | 30% | 7% |

| 2043 | 55% | 30% | 5% |

| 2044 | 55% | 30% | 4% |

| 2045 | 55% | 30% | 3% |

| 2046 | 55% | 30% | 2% |

| 2047 | 55% | 30% | 1% |

| 2048 | 55% | 30% | 0% |

The City’s AAA financial credit rating was reaffirmed by S&P Global Ratings in 2024, with a stable outlook. This is an excellent credit rating for a City of Guelph’s size and is higher than other similar sized single-tier cities. While not the only factor, a higher credit rating generally results in lower borrowing costs.

There are many elements considered as part of a credit rating decision, but two key factors for Guelph’s AAA credit rating are a strong liquidity position due to high reserve balances, and low debt relative to operating revenue. Upon reaffirming the credit rating, S&P cautioned that a lower rating is possible in the future if projections for debt outstanding surpasses 30 per cent of operating revenues. Based on the debt strategy outlined above, projections of debt as a percentage of operating revenue are expected to surpass 30 per cent in 2028 . Additionally, as outlined in the financial strategy documents, the capital budget and forecast will significantly draw down capital reserve fund balances over the next several years. These factors will very likely lead to a lower future credit rating for the City in the short- to medium-term.

The above noted metrics provide helpful guardrails for understanding risk associated with debt, but it is also important to note that the ability to defer capital expenditures to reduce reliance on debt is another factor considered in the credit rating process. This is an assessment of whether spending in the capital plan is discretionary or required to continue providing reliable services for the community. Information from the Asset Management Plan about the deferred maintenance backlog, tied to the Infrastructure Renewal Strategy, and legislated growth targets, in addition to the City’s Housing Pledge (underpinning the Growth Strategy) provide key insight into the ability defer expenditures. Failure to meet legislative requirements or inadequate spending on infrastructure renewal and replacement would also negatively impact the City’s credit rating.

| 2025 confirmed budget |

|---|

| Council reports |

| Budget board |

Related pages

City budget

Previous annual budgets

Budget manual

Budget Policy

Watch and listen

Mayoral direction

Latest updates

Timeline

October 17: Guelph’s 2025 Budget Update released

October 30: Special Council – 2025 Budget Update

November 19: Special Council – 2025 budget Public delegations

November 27: Special Council – 2025 budget amendments

January 22: Special Council – 2025 budget local boards and shared services