Once logged in you can:

- Get your property tax information and account balance

- Sign up, change, or cancel pre-authorized payment plans

- Sign up for e-billing

- Change your mailing address or contact information

- Print tax statements and bills

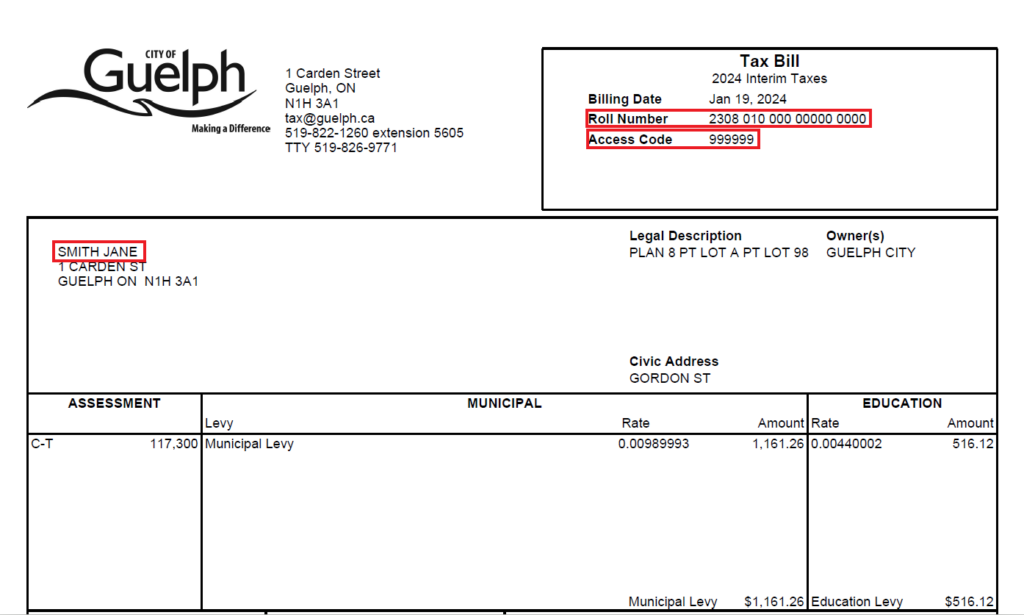

To create or log in to your account, you will need:

- the property address

- the property roll number

- the access code shown on your tax bill

How to find your roll number and access code

How to use the Property Tax Portal

How to pay your property taxes

Sign up for a pre-authorized payment plan

Pre-authorized payments are a convenient way to pay property tax by setting up automatic monthly payments or scheduled payments on tax due dates four times a year.

Choose a pre-authorized payment plan

Pay through your bank or financial institution

You can pay your property taxes at your bank or financial institution using online banking, telephone banking, at an automatic teller or in-person.

To pay online or by phone, use your tax roll number (19-digit number on your bill) and make your payment to Guelph Tax. Contact your bank to arrange payments in person, by phone or online if you have trouble finding the payee’s name.

Credit card payments

Paymentus is a third-party provider that securely processes online property tax payments on behalf of the City of Guelph.

You will need:

- Your property tax roll number

- The balance owed on your property tax bill

- Your credit card (VISA or Mastercard)

Visit Paymentus to make your payment online or call 1-855-288-5239.

Paymentus will ask you to pay a convenience fee and provide you with a confirmation number when the transaction is complete.

Why is there a convenience fee?

Paymentus charges a convenience fee to cover payment handling and processing. The City of Guelph does not receive any part of this convenience fee. Paymentus Corporation is an independent company providing a service for the City of Guelph.

Can I use a credit card to pay my taxes at City Hall?

No. The Paymentus service is provided for anyone who wishes to pay property taxes using a credit card.

Pay by cheque

Please allow several days for mail delivery, and make your cheque payable to the City of Guelph

City of Guelph

Finance Department

Taxation and Revenue Division

1 Carden Street

Guelph ON N1H 3A1

Pay in person

You will need the property address and/or tax roll number.

Cash, debit or cheque payments are accepted at City Hall, 1 Carden Street, Guelph

(after-hours drop box is west of the main entrance, please don’t leave cash in the drop box)

Need more help?

[email protected]

519-822-1260 extension 5605

TTY 519-826-9771