On this page

Budget summary

On November 29, 2023, Council adopted Guelph’s first four-year multi-year budget (MYB), covering the years 2024 to 2027. The 2025 budget confirmation is Guelph’s first confirmation year in this four-year MYB cycle. The budget confirmation process, which includes reviewing, updating, and confirming the budget, is the mechanism for readoption in the City’s Budget Policy.

In November 2023, Guelph’s 2025 budget was initially approved with a tax levy increase of 9.80% compared to 2024. On February 28, a Mayoral Direction was released directing staff to prepare an update to the adopted 2025 budget with a property tax impact of no more than four per cent, split proportionately between the City and local boards and shared services (LBSS) agencies.

The 2025 budget confirmation process focused on prioritization of the City’s needs to balance moving strategic priorities forward with affordability pressures; this process included both new investments proposed in the 2025 adopted budget, as well as existing services in the base budget. This year, for the first time, the City services and Local Boards and Shared Service (LBSS) agencies’ budgets were considered separately. This separation helped to align the processes with updated budget legislation, with the City services portion of the budget following the Strong Mayor process, and LBSS budgets being presented to Council for approval in alignment with the pre-Strong Mayor budget process. LBSS agencies presented their 2025 budget updates to Council on January 22, 2025. Details about the confirmed 2025 budgets for LBSS agencies can be found on the LBSS tab of the budget website. The following budget information relates to the City portion of Guelph’s 2025 budget confirmation.

To bring forward a 2025 budget update in line with the Mayoral Direction, the City’s tax-supported budget is capped at no more than a 2.63 per cent increase over 2024, requiring a $15.5 million dollar reduction from the City’s portion of the previously-adopted 2025 budget.

To achieve this, staff developed a prioritization framework to assess the criticality of service delivery and budget decisions for 2025. This process varied slightly between the operating and capital budget, each of which are detailed in the operating and capital sections of this website.

The Draft 2025 Budget Update was released on October 17 and presented to Council on October 30. Following a series of mayor-led townhalls, the Mayor’s Proposed 2025 Budget Update was released on November 14. Council met on November 27 to discuss and amend the proposed budget which was then subsequently deemed adopted on the same day.

The overriding themes that emerged from the development of the 2025 budget confirmation included:

- Prioritizing housing by advancing investments that enable and service growth.

- Investing in maintaining City assets in a state of good repair to support uninterrupted delivery of high priority services.

- Striving for affordability for the community by prioritizing new investments and existing services using the same set of criteria

Guelph’s 2025 confirmed budget reflects these themes, and accomplishes several objectives:

- Meets the affordability target set out in the Mayoral Direction on budget.

- Presents a fully funded 10-year capital budget and forecast that enables the City to meet its part of the Housing Pledge and maintain high priority assets.

- Leverages existing grant opportunities and leaves space for future grants to help mitigate tax increases.

- Significant investment in revitalizing the downtown.

- Continued progress on environmental goals through ongoing investment in transit, electrification, and active transportation, which is partially advanced through a reduction in tax support for parking.

Key takeaways

- The proposed capital budget and forecast takes a long-term view, maximizing reserve and debt capacity. It relies heavily on inter-reserve fund borrowing in the earlier years, and staff will continue to pursue grant opportunities as they arise to bolster that forecast.

- The timing of development charge collections and exemptions are uncertain, and legislated exemptions and discounts continue to put pressure on the tax supported capital reserve forecast.

- The debt forecast stays well within legislated limits and City policy targets, but will exceed S&Ps threshold, making a future credit rating reduction likely. Debt capacity has been reserved after 2030 to support potential development charge collection delays.

- Interest rates are decreasing, so the strategy of delaying debt issuances for previously approved projects to begin in 2025 continues to make sense.

- There is no capacity to add or increase tax-supported capital projects without an offsetting reduction or increase to capital funding.

- Tax-supported capital funding is a constraint to accelerating progress on integrated corridor reconstruction projects, which are funded from taxes, rates, and development charges.

- While inflation overall is returning to the Bank of Canada’s target range, the Non-Residential Building Construction Price Index (NRBCPI) is still higher than normal which impacts the capital budget and forecast.

Future Guelph Strategic Plan alignment

Implementation of the Future Guelph Strategic Plan remained an important factor in determining priorities for the 2025 confirmation budget. However, as the City balances progress toward Council’s objectives with affordability pressures, the pace of implementation in some areas has slowed. Through the budget process, further prioritization within the Future Guelph Strategic Plan occurred, and focused on areas of the plan tied to housing, affordability, accountability, and core infrastructure renewal. Delivery of action items related to non-core infrastructure, and optional programs and services were scaled over a longer implementation period.

The following provides more details related to investments and impacted initiatives as part of the 2025 confirmed budget:

Foundations

- Progress towards the development of a People and Culture Plan will continue, but over a longer period than originally planned.

- A centralized data management platform will support accountability through improved data security, Strategic Plan reporting, and the ability to make data-driven decisions.

- Infrastructure Renewal was prioritized as part of the review of the 10-year capital budget. Assets associated with higher risks and those directly associated with new housing development were maintained in the budget, while others were pushed further outside the 10-year timeframe. This will support continued delivery of high priority services, while lower priority services could experience interruptions resulting from asset condition.

- While providing excellent customer service remains a priority, some aspects of the Service Simplified Strategy, such as centralization of all customer service functions, will be implemented over a longer timeframe.

- To support digital service options, improvements of some foundational IT systems are moving forward at a slower pace, including both the Customer Relationship Management and Records Management systems.

City Building

- Policy work that supports initiatives across the housing continuum, investments towards quicker development application review, and infrastructure that directly enables new housing starts have all been prioritized within the budget.

- Implementation of the Recreation and Trail Master Plans have been slowed as part of capital reprioritization, which may reduce the City’s ability to increase attraction to parks and amenities in the short term.

- The opening of Baker District Library and South End Community Centre are on track and expected to open in late 2026.

- Implementation of the Guelph Transit Future Ready Action Plan will continue at a slower pace. New federal government funding for transit has been announced, and the pace of transit expansion will be revisited as part of the 2026 budget confirmation process after more information is provided.

- Exploration of new transportation technologies will be limited to support the focus on housing enabling infrastructure.

Environment

- Continued investment in fleet and transit electrification will support the continued reduction of Guelph’s carbon footprint.

- Progress on implementation of some actions in the climate adaptation plan and investments in circular economy initiatives have been slowed, and timelines associated with the Urban Forest Management Plan implementation have been expanded.

- Investment in stormwater management is focused on the highest risk areas across the city, and investment in lower risk areas have been deferred.

- Community outreach efforts related to environmental programs – water reduction initiatives in particular – have been reduced.

People and Economy

- There are continued investments in paramedic services to support the City in meeting its response time targets.

- Investment for downtown streetscaping was increased to reflect Council’s September 2024 decision on the Downtown Infrastructure Renewal Plan, inclusive of underground waste bins and a self-cleaning washroom.

Operating budget investment

The budget is the tool that generates the revenue needed to fund the cost of delivering services to the community. These revenues are generated through both property taxes and user rates.

The property tax revenue increases to support the City’s share of the confirmed budget are detailed in Table 1.

| Levy type | 2025 adopted | 2025 confirmed | 2026 forecast | 2027 forecast | 2028 Forecast |

|---|---|---|---|---|---|

| Tax levy – City service | 7.16% | 3.66% | 4.51% | 3.86% | 3.23% |

| Tax levy – Guelph General Hospital (GGH) | 0.23% | 0.00% | 0.23% | (0.21%) | 0% |

The net impact of the 2025 Budget Confirmation is outlined in Table 2, by City department. Building upon the 2024 adopted budget, Table 2 identifies the 2025 base budget increase. This includes inflationary increases, adjustments for historical trends and the 50 per cent phase-in of staffing investments from 2024. Service recommendations are City investments categorized as operating impacts from capital, growth, service enhancement, service reduction or capital funding. Assessment growth revenue is budgeted at 1.15 per cent of the base budget in 2025. Assessment growth revenue is allocated proportionately between the City and LBSS agencies, with 67 per cent distributed to the City. Finally, the Guelph General Hospital levy sits outside of the City tax target.

Details surrounding the base budget and the various service recommendation categories are provided in the operating budget.

| City department | 2024 adopted budget | 2025 base budget | 2025 base budget change % | 2025 service recommen- dations | 2025 total budget | 2025 net change | 2025 tax levy impact |

| Mayor | 529,990 | 16,560 | 3.12% | (26,600) | 519,950 | (1.89%) | (0.00%) |

| Council | 839,970 | 24,790 | 2.95% | 42,500 | 907,260 | 8.01% | 0.02% |

| Chief Administrator’s Office Administration | 940,502 | 23,050 | 2.45% | 342,000 | 1,305,552 | 38.81% | 0.11% |

| Strategic Initiatives & Intergovernmental Services | 6,020,763 | 638,429 | 10.60% | 222,350 | 6,881,542 | 14.30% | 0.27% |

| Finance | 3,356,019 | 274,449 | 8.18% | 28,068 | 3,658,536 | 9.01% | 0.09% |

| Infrastructure, Development and Environment Administration | 454,140 | 16,180 | 3.56% | 0 | 470,320 | 3.56% | 0.00% |

| Planning and Building Services | 5,387,565 | 220,291 | 4.09% | 207,149 | 5,815,005 | 7.93% | 0.13% |

| Facilities and Energy Management | 5,237,472 | 430,370 | 8.22% | 115,660 | 5,783,502 | 10.43% | 0.17% |

| Engineering and Transportation Services | 7,146,978 | 270,696 | 3.79% | (18,582) | 7,399,092 | 3.53% | 0.08% |

| Environmental Services | 15,147,814 | 713,555 | 4.71% | (2,094,618) | 13,766,751 | (9.12%) | (0.43%) |

| Economic Development and Tourism | 2,685,630 | 121,794 | 4.54% | 0 | 2,807,424 | 4.54% | 0.04% |

| Public Services Administration | 703,610 | 8,213 | 1.17% | 0 | 711,823 | 1.17% | 0.00% |

| Parks | 12,827,056 | (62,396) | (0.49%) | (152,174) | 12,612,486 | (1.67%) | (0.07%) |

| Culture and Recreation | 9,513,515 | 511,851 | 5.38% | 279,618 | 10,304,984 | 8.32% | 0.24% |

| Guelph Transit | 27,991,341 | (89,734) | (0.32%) | 510,233 | 28,411,840 | 1.50% | 0.13% |

| Operations | 19,384,905 | 1,006,037 | 5.19% | (69,760) | 20,321,182 | 4.83% | 0.29% |

| Guelph- Wellington Paramedic Services | 10,151,659 | (96,134) | (0.95%) | 391,332 | 10,446,857 | 2.91% | 0.09% |

| Fire Services | 31,155,917 | 920,056 | 2.95% | (18,050) | 32,057,923 | 2.90% | 0.28% |

| Corporate Services Administration | 585,160 | 20,540 | 3.51% | 0 | 605,700 | 3.51% | 0.01% |

| Human Resources | 3,241,540 | 147,198 | 4.54% | 0 | 3,388,738 | 4.54% | 0.05% |

| Information Technology | 5,170,799 | 173,767 | 3.36% | 52,042 | 5,396,608 | 4.37% | 0.07% |

| City Clerk’s Office | 1,760,490 | (119,564) | (6.79%) | 136,700 | 1,777,626 | 0.97% | 0.01% |

| Strategic Communications & Community Engagement | 2,741,864 | 521,988 | 19.04% | (138,355) | 3,125,497 | 13.99% | 0.12% |

| Legal and Court Services | 1,281,995 | (147,015) | (11.47%) | 139,233 | 1,274,213 | (0.61%) | (0.00%) |

| Internal Audit | 317,588 | (34,790) | (10.95%) | 0 | 282,798 | (10.95%) | (0.01%) |

| General expenses and revenues | (411,060) | 1,927,013 | (468.79%) | 414,810 | 1,930,763 | (569.70%) | 0.72% |

| Reserve Funding | 38,605,447 | (21,814) | (0.06%) | 7,031,006 | 45,614,639 | 18.16% | 2.16% |

| Affordable Housing | 100,000 | 0 | 0 | 225,000 | 325,000 | 225.0% | 0.07% |

| Total City service impact | 212,868,669 | 7,715,380 | 3.62% | 7,319,562 | 227,903,611 | 7.06% | 4.63% |

| Less: Assessment Growth Revenue | (2,501,967) | (423,596) | 16.93% | (208,636) | (3,134,199) | 25.27% | (0.97%) |

| Total 2025 City budget impact | 210,366,702 | 7,291,784 | 3.47% | 7,110,926 | 224,769,412 | 6.85% | 3.66% |

| Guelph General Hospital Levy | 750,000 | (750,000) | (100.00%) | 0 | 0 | (100.00%) | 0.00% |

The City’s non-tax supported budget is comprised of stormwater services, water services, wastewater services, parking services, Ontario Building Code Administration (OBCA) and court services. The gross impact of the 2025 confirmed budget to the City’s non-tax-supported services are outlined in Table 3.

| City department | 2024 adopted budget | 2025 base budget | 2025 base budget change % | 2025 service recommendations | 2025 total budget | 2025 net change |

|---|---|---|---|---|---|---|

| Ontario Building Code | 6,655,045 | (1,315,440) | (19.8%) | 161,200 | 5,500,805 | (17.3%) |

| Stormwater | 12,449,740 | 849,031 | 6.8% | 1,229,443 | 14,528,214 | 16.7% |

| Water | 35,855,563 | 1,698,813 | 4.7% | 1,459,801 | 39,014,177 | 8.8% |

| Wastewater | 38,788,228 | 1,928,049 | 5.0% | 1,075,953 | 41,792,230 | 7.7% |

| Parking | 3,987,518 | 593,093 | 14.9% | 24,717 | 4,605,328 | 15.5% |

| Court Services | 5,526,600 | 203,400 | 3.7% | 522,200 | 6,252,200 | 13.1% |

| Total non-tax-supported investment | 103,262,694 | 3,956,946 | 3.8% | 4,473,314 | 111,692,954 | 8.2% |

The overall increase to the utility rate supported services (water, wastewater, and stormwater) for the average residential customer is outlined in Table 4.

| Rate type | 2025 adopted $ millions | 2025 adopted rate impact | 2025 confirmed $ millions | 2025 confirmed rate impact |

|---|---|---|---|---|

| Rate – City services | 8.2 | 10.21% | 4.7 | 5.69% |

The average three-person household consumes 180 cubic meters in a year and has an average impervious area of 188 square meters. The residential rate impacts to the average residential bill are identified Table 5.

| Description | 2025 Adopted | 2025 confirmed |

|---|---|---|

| Increase to the average residential household per month | $9.17 | $5.12 |

Capital budget investment

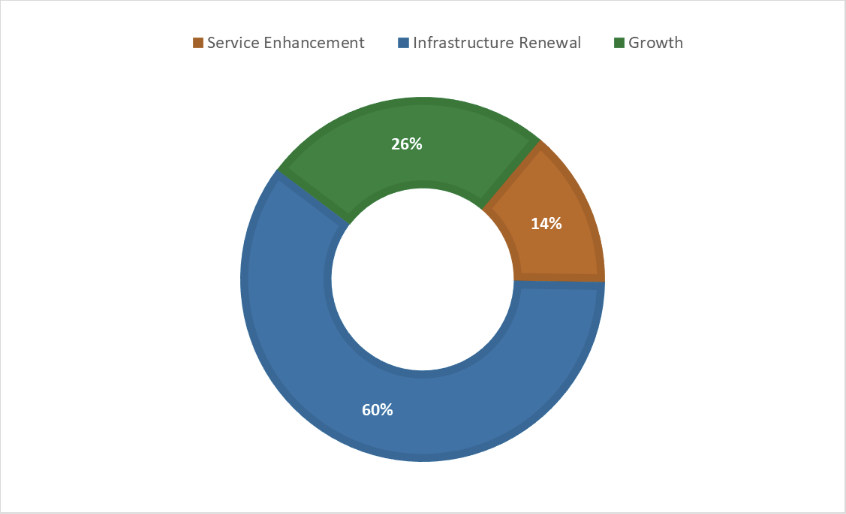

From a capital perspective, the City is projected to spend $2.3 billion over the next ten years with $1.1 billion in the next four years. This work can be categorized into three drivers: infrastructure renewal, growth, and service enhancement. Infrastructure renewal remains the largest focus, followed by growth-related capital investment supporting the mandated requirement for our population to grow to over 200,000 people by 2051, Figure 1.

Figure 1 2025 confirmed capital budget investment by category over the 10-year budget:

View Figure 1 data

| Capital budget category | Total 2025 capital budget confirmed investment – 10-year ($ millions) |

|---|---|

| Service enhancement | 344.2 |

| Infrastructure renewal | 1,396.4 |

| Growth | 600.8 |

From an investment by year perspective, the capital budget can be quite variable as the size and complexity of projects each year can be vastly different, demonstrated in Table 6.

| Year | Annual capital budget investment |

|---|---|

| 2025 adopted | 227.2 |

| 2025 confirmed | 198.7 |

The capital budget is funded by various revenue sources, highlighted in Table 7.

| Funding source | 2024 adopted | 2025 adopted | 2025 confirmed |

|---|---|---|---|

| Grants and subsidies | 14.6 | 23.3 | 30.8 |

| Development charges | 47.2 | 75.7 | 61.5 |

| Rate funding | 65.7 | 63.4 | 43.7 |

| Rate funded debt | 7.8 | 4.0 | 4.0 |

| Tax funding | 62.6 | 54.6 | 46.6 |

| Tax funded debt | 0.0 | 0.0 | 5.7 |

| Other | 3.8 | 6.2 | 6.4 |

| Total capital funding | 201.7 | 227.2 | 198.7 |

2025 adopted budget to confirmed budget

Tax-supported services

Table 9 through 14 identify the changes made to the tax-supported 2025 City services adopted budget through the various stages of the 2025 budget confirmation process.

| Adopted budget | City services $ | City services tax levy impact % | Local Boards and Shared Services $ | Local Boards and Shared Services % | Total $ | Total % |

|---|---|---|---|---|---|---|

| Base budget | 213,618,670 | 0.00% | 111,101,261 | 0.00% | 324,719,931 | 0.00 |

| Adopted budget increase | 25,751,587 | 7.93%> | 9,058,176 | 2.79% | 34,809,763 | 10.72% |

| Total adopted property tax levy and payment in lieu of taxes | 239,370,257 | 7.93% | 120,159,437 | 2.79% | 359,529,694 | 10.72% |

| Assessment growth revenue | (2,501,967) | (0.77%) | (1,232,312) | (0.38%) | (3,734,279) | (1.15%) |

| Hospital Levy | – | 0.00% | – | 0.00% | 750,000 | 0.23% |

| Adopted net tax impact | 23,249,620 | 7.16% | 7,825,864 | 2.41% | 31,825,484 | 9.80% |

City services adjustments to adopted tax-supported 2025 budget included in the 2025 confirmed budget.

| Draft budget | 2025 net requirement $ | 2025 tax levy |

|---|---|---|

| Adopted net tax impact | 23,249,620 | 7.16% |

| Trend Analysis Adjustment | (971,740) | (0.30%) |

| Increased Revenues | (1,090,524) | (0.34%) |

| Inflationary impacts | 960,805 | 0.30% |

| Base Budget Adjustments | (622,514) | (0.19%) |

| 000848 CORP – South End Community Center – Deferred further operating cost phase-in to 2026/27 when facility opens. | (866,248) | (0.27%) |

| 001016 CORP – Baker District – Deferred further operating cost phase-in to 2026,27 when facility opens | (776,100) | (0.24%) |

| IT0060 Enterprise Data & Analytics – Maintained but refined costs | (75,000) | (0.02%) |

| IT0074 Digital Enhancements – Maintained but refined costs | (45,000) | (0.01%) |

| IT0086 Corporate Voice Replacement – Deferred to 2027 | (181,600) | (0.06%) |

| IT0115 Customer Relationship Management system – Deferred to 2027, 2029, 2030 with increase in costs to $721,000 | (216,209) | (0.07%) |

| IT0116 Modernization for Guelph.ca – Deferred to 2026 | (50,000) | (0.02%) |

| IT0119 IT Cloud Infrastructure – Deferred to 2026 | (148,000) | (0.05%) |

| IT0120 Data Warehouse Infrastructure – Deferred to 2026 | (116,646) | (0.04%) |

| PK0125 City-wide -Trails Enhancements – Eliminated | (2,300) | (0.00%) |

| PK0128 Downtown Riverwalk – Deferred to 2026 | (6,700) | (0.00%) |

| PO0014 Park New Equipment – Deferred to 2026 | (2,000) | (0.00%) |

| PO0037 Urban Forest Management Plan Implementation – Deferred to 2026 | (10,000) | (0.00%) |

| PO0051 Mower – Deferred to 2026 | (14,000) | (0.00%) |

| PO0056 Downtown Tree Canopy and Associated Infrastructure New/Replacement Planting – New | 600 | 0.00% |

| RD0385 Cycling Master Plan Implementation – Deferred to 2028 | (41,000) | (0.01%) |

| RD0452 Cycling Network Pavement Markings – Maintained but refined costs | 41,500 | 0.01% |

| RD0473 Sidewalk Plow – Deferred to 2026 | (56,600) | (0.02%) |

| RF0091 South End Community Centre Equipment Growth – Deferred to 2026 | (34,200) | (0.01%) |

| TC0043 Bus Shelter Purchase – Deferred to 2026 | (22,800) | (0.01%) |

| TC0072 Digital Signs – Deferred to 2026 | (257,600) | (0.08%) |

| TC0079 Route Review – Year 3 (ICIP-GUE-01) replaced TC0064-010 – Transit Route 5 Deferral to 2025 | (786,891) | (0.24%) |

| TC0092 Route Review – Year 4 (ICIP-GUE-01) – Deferred to 2026 | (1,322,600) | (0.41%) |

| TC0094 Conestoga Route Requirements – Maintained but refined costs | 107,500 | 0.03% |

| WC0016 Solid Waste Collection Trucks New – Deferred to 2026 | (109,000) | (0.03%) |

| 001153 CS – IT – Corporate Applications Analyst JDE & Payments – Eliminated | (153,871) | (0.05%) |

| 001160 CS – IT – Emergency Services Specialist – Deferred to 2026 | (133,600) | (0.04%) |

| 001193 CS – IT ERP Program Long-term Support – Maintained but refined costs | (89,100) | (0.03%) |

| 001360 CS – IT Operating Impact IT0075 Data Quality Analyst – Deferred to 2026 | (172,500) | (0.05%) |

| 001424 PS – Parks – Urban Forest Technologist – Maintained but refined costs | (96,362) | (0.03%) |

| 001487 Council – Council Admin Assistant | 54,600 | 0.02% |

| 001262 PS – Paramedic Business Case 2024 | (22,173) | (0.01%) |

| 000899 PS – Operations – Amanda Upgrade and Bylaw Review – Removed | (25,000) | (0.01%) |

| 000937 CS – City Clerk’s Office – Board and Committee Coordinator – Deferred to 2026, pending Council policy decision in 2025 | (56,700) | (0.02%) |

| 001122 PS – Culture – Public Art Reserve Fund Funding – Deferred to 2027 | (50,000) | (0.02%) |

| 001167 PS – Recreation – Parks and Recreation Master Plan – Deferred to 2026 | (96,017) | (0.03%) |

| 001236 PS – Transit – Transit Technology Advisor – Deferred to 2026 | (68,600) | (0.02%) |

| 001292 IDE – Compliance and Performance – Guelph Tool Library Agreement – Deferred to 2027 | (80,000) | (0.02%) |

| 001342 PS – Parks – Electrician – Offset expense to 2025 adopted budget with reductions identified through trend analysis | (15,989) | (0.00%) |

| 001361 CS – Clerks – Advisory Committees Reimbursements and Training – Deferred to 2027 | (50,000) | (0.02%) |

| 001449 IDE – Facilities & Energy Management – Drill Hall Maintenance and Security – New, in-year Council decision | 60,000 | 0.02% |

| 001472 CS – Courts – APS Parking Expansion – New, in-year Council decision | (189,000) | (0.06%) |

| 001478 PS – Transit – Pilot Program Youth Ride Free and Seniors One Day Free – New $174,000 offset with Reserve Funding | – | 0.00% |

| 001491 CS – City Clerk’s Office – Increase to Election Reserve – New, in-year Council decision | 80,000 | 0.02% |

| Optimization of resourcing, supplies, training, conferences and communication expenses within the Mayor and Council budgets. | (38,700) | (0.01%) |

| Reduction in funding used to respond to emerging priorities, corporate innovation, and City-wide staff engagement. | (38,000) | (0.01%) |

| Early termination of the Welcoming Streets Community Benefit Agreement (CBA), with the City instead seeking guidance from the Wellington-Guelph Health and Housing Community Planning Table for the optimal Guelph community service support structure and the in-year approval of $450,000 in August 2024 for immediate basic needs funding to the end of 2025. | (206,550) | (0.06%) |

| Eliminate measurement and external engagement support for the Community Plan (no levy impact as it was reserve funded) | 0 | 0.00% |

| Increasing revenues through fee adjustments and adding utility and court services billing arrears to the property’s tax bill, as well as reducing consulting support for property tax appeal matters. | (60,000) | (0.02%) |

| Corporate savings from deferred customer relationship management technology and associated operating impacts. | (138,355) | (0.04%) |

| Elimination of external Dropbox file sharing service. | (15,000) | (0.00%) |

| Elimination of internal IT Status Page. | (7,000) | (0.00%) |

| Elimination of the development and implementation of an enhanced KPI reporting platform. | (20,000) | (0.01%) |

| Deferred implementation of a Human Resources Information System. | (75,000) | (0.02%) |

| Elimination of the Termite Management Program | (123,351) | (0.04%) |

| Reduction to corporate cleaning capacity by 17 per cent. Further opportunities for efficiencies are expected through a value for money audit related to cleaning services scheduled in 2025. | (74,590) | (0.02%) |

| Reduced investment in Energy and Climate Change initiatives. | (153,867) | (0.05%) |

| Additional savings from the adopted budget for Guelph’s Blue Box program transition planning and implementation to the producer responsibility model. | (100,860) | (0.03%) |

| Reduce the operating hours of the Public Drop-off Centre (PDO) by one day per week. | (413,100) | (0.13%) |

| Reduce a portion of solid waste outreach and education and eliminate composition audits and eliminate the Solid Waste Curbside Inspection Program | (152,080) | (0.05%) |

| Reduction of the Youth Subsidy for indoor and outdoor rental facilities, increase in fees by 5% (from a subsidy of 47.5% to 42.5%). | (137,500) | (0.04%) |

| Elimination of the Guelph Bicentennial events of $,000 that were funded from operating contingency reserves. City staff capacity will be allocated to lead the community working groups. | 0 | 0.00% |

| proactive forestry works and reduced response time to non-critical tree related needs. | (200,500) | (0.06%) |

| Work related to the Council approved Urban Forest Management plan will continue to be implemented but over a longer period of time. | (111,810) | (0.03%) |

| Elimination of funding for accreditation. Policies and standards will remain in place. | (18,050) | (0.01%) |

| Capital funding transfer | (4,932,234) | (1.52%) |

| Mayor’s Draft 2025 City services budget update | 8,413,894 | 2.59% |

| Proposed budget | 2025 net requirement $ | 2025 tax levy impact % |

|---|---|---|

| Mayor’s draft 2025 City Services budget update | 8,413,894 | 2.59% |

| Assessment Growth Revenue | – | 0.00% |

| Affordable and Other Non-market Housing | 305,000 | 0.09% |

| Emergency Funding for homelessness, mental health and addiction crisis | 300,000 | 0.09% |

| Welcoming Streets Initiative | 201,500 | 0.06% |

| Guelph Tool Library | 62,000 | 0.02% |

| Youth subsidy | 68,750 | 0.02% |

| Community Benefit Agreement Review | 60,000 | 0.02% |

| Transit Route 5 | 389,000 | 0.12% |

| Free transit for high school during summer | 30,000 | 0.01% |

| Free transit for tier A and B qualified applicants of the affordable bus pass program | 143,000 | 0.04% |

| Proactive forestry works | 200,500 | 0.06% |

| Bicentennial | 103,000 | 0.03% |

| Increase to capital funding transfer | 150,000 | 0.05% |

| Mayor’s proposed 2025 City Services budget update | 10,426,644 | 3.21% |

| Budget amendments | 2025 net requirement $ | 2025 tax levy impact % |

|---|---|---|

| Mayor’s proposed 2025 City Services budget update | 10,426,644 | 3.21% |

| 001502 CORP – PK0198 Beaumont Park funding for design | 100,000 | 0.03% |

| 000937 CS – City Clerk’s Office – Board and Committee Coordinator | 56,700 | 0.02% |

| 001505 CORP – Restore 100RE Funding for capital project GG0261 | 996,133 | 0.31% |

| 001430 IDE- Facilities & Energy Management – Cleaning & Project Management Reduction | 153,867 | 0.05% |

| 001507 CAO – SIIS – Increase Community Grants | 167,400 | 0.05% |

| 2025 confirmed City services budget | 11,900,744 | 3.66% |

| Budget Update | 2025 net requirement $ | 2025 tax levy impact % |

|---|---|---|

| Adopted net tax impact | 7,825,864 | 2.41% |

| Guelph Police Services | 856,764 | 0.26% |

| County of Wellington | 1,833,200 | 0.57% |

| Guelph Public Library | (441,391) | (0.14%) |

| Wellington-Dufferin-Guelph Public Health | 43,521 | 0.01% |

| The Elliott Community | 0 | 0.00% |

| 2025 Confirmed LBSS budget | 10,117,959 | 3.12% |

| Adopted budget | City services $ | City services tax levy impact % | LBSS $ LBSS | tax levy impact % | Total $ | Total % |

|---|---|---|---|---|---|---|

| Base budget | 213,618,670 | 0.00% | 111,101,261 | 0.00% | 324,719,931 | 0.00% |

| Confirmed budget increase | 15,034,942 | 4.63% | 11,350,280 | 3.50% | 26,385,222 | 8.13% |

| Total adopted property tax levy and payment in lieu of taxes | 228,653,612 | 4.63% | 122,451,541 | 3.50% | 351,105,153 | 8.13% |

| Assessment growth revenue | -3,134,199 | -0.97% | -1,232,312 | -0.38% | -4,366,511 | -1.34% |

| Hospital Levy | – | 0.00% | – | 0.00% | – | 0.00% |

| Guelph’s total confirmed 2025 net tax impact | 11,900,743 | 3.66% | 10,117,968 | 3.12% | 22,018,711 | 6.78% |

The median residential property value for a single-family detached home in 2024 is $408,000. From a property tax bill perspective, the payment for the City portion of property taxes for 2025 is estimated in table 14, below.

| Levy type | 2025 adopted | 2025 confirmed |

|---|---|---|

| 2024 annual tax – median residential property | $4,759.90 | $4,759.90 |

| Annual City service tax increase over prior period | $340.81 | $174.21 |

| Annual GGH tax increase over prior period | $10.95 | $0.00 |

| Annual local boards and shared services increase over prior period | $114.71 | $148.51 |

These estimates are based on 2024 assessed values and 2024 tax policy and will change annually as updated assessment values are available.

Capital budget

Table 15 through 19 identify the changes made to the 2025 capital City services adopted budget through the various stages of the 2025 budget confirmation process by program of work.

| Adopted budget | City services $ |

|---|---|

| Corporate Facilities, Public Works and Bylaw | 7,066,900 |

| Corporate Plans, Programs and Technology | 8,986,100 |

| Culture and Recreation | 4,829,800 |

| Emergency Services | 6,203,200 |

| Parking and Transit Services | 19,001,000 |

| Parks and Open Spaces | 15,361,100 |

| Solid Waste Services | 3,416,800 |

| Transportation Network | 85,936,380 |

| Water Management | 76,356,400 |

| 2025 adopted City services capital budget | 227,157,680 |

City services adjustments to adopted 2025 capital budget included in the 2025 confirmed budget, by program of work.

| Draft budget | City services $ |

|---|---|

| 2025 adopted City services capital budget | 227,157,680 |

| Corporate Facilities, Public Works and By-Law | (350,000) |

| Corporate Plans, Programs and Technology | 714,100 |

| Culture and Recreation | (623,050) |

| Emergency Services | 1,098,050 |

| Parking and Transit Services | 2,265,000 |

| Parks and Open Spaces | (2,335,000) |

| Solid Waste Services | 2,604,834 |

| Transportation Network | (27,544,070) |

| Water Management | (5,535,681) |

| Mayor’s Draft 2025 City services budget update | 197,451,863 |

| Proposed budget | City services $ |

|---|---|

| Mayor’s Draft 2025 City services budget update | 197,451,863 |

| Culture and Recreation – CT0011 Culture – Implementation of Culture Plan 2030 | 75,000 |

| Transportation Network – PK0125 City-wide Trails Enhancement, for accessibility | 75,000 |

| Transportation Network – TF0028 New Intersection/Pedestrian Signals – advance crosswalk at Margaret Park in exchange for a crosswalk on York Road | 0 |

| Transportation Network – Veteran’s crosswalk | 0 |

| Mayor’s Proposed 2025 City services capital budget | 197,601,863 |

| Adopted budget | City services $ |

|---|---|

| Mayor’s Proposed 2025 City services capital budget | 197,601,863 |

| Corporate Plans, Programs and Technology – GG0261 100RE initiatives | 996,133 |

| Parks and Open Space – PK0198 Beaumont Park | 100,000 |

| 2025 confirmed City services capital budget | 198,697,996 |

| Adopted budget | City services $ |

|---|---|

| 2025 confirmed City services capital budget | 198,697,996 |

| Local boards and shared services capital budget | 7,004,308 |

| Guelph’s total confirmed 2025 capital budget | 205,702,304 |

Non-tax-supported services

Table 20 through 23 identifies the gross changes made to the non-tax-supported 2025 City services adopted budget through the various stages of the 2025 budget confirmation process.

| Adopted budget | City services $ |

|---|---|

| Ontario Building Code | 6,838,805 |

| Stormwater | 14,281,290 |

| Water | 39,725,783 |

| Wastewater | 42,708,988 |

| Parking | 4,605,328 |

| Court Services | 5,706,600 |

| Adopted 2025 non-tax-supported budget | 113,866,794 |

| Draft Budget | City services $ |

|---|---|

| Adopted 2025 non-tax-supported budget | 113,866,794 |

| Ontario Building Code | (1,338,000) |

| Stormwater | 246,924 |

| Water | (1,048,140) |

| Wastewater | (916,758) |

| Parking | – |

| Court Services | 545,600 |

| Draft 2025 non-tax-supported budget | 111,356,420 |

| Description | City Services $ |

|---|---|

| Draft 2025 Budget Update | 111,356,420 |

| Water- Water Services outreach and education programs | 263,520 |

| Water – Water promotional and administrative investments | 48,643 |

| Water – Water program and planning for best practices | 24,371 |

| Mayor’s Proposed 2025 Budget Update – non-tax-supported City Services | 111,692,965 |

No further adjustments were made to the non-tax-supported budget through the amendments. The Mayor’s proposed non-tax-supported 2025 budget was confirmed as presented on November 27, 2024.

| Description | City Services $ |

|---|---|

| 2025 confirmed– non-tax-supported City Services | 111,356,420 |

| Local boards and shared services | 1,863,400 |

| Guelph’s total 2025 confirmed gross non-tax budget | 113,556,354 |

| 2025 confirmed budget |

|---|

| Council reports |

| Budget board |

Related pages

City budget

Previous annual budgets

Budget manual

Budget Policy

Watch and listen

Mayoral direction

Latest updates

Timeline

October 17: Guelph’s 2025 Budget Update released

October 30: Special Council – 2025 Budget Update

November 19: Special Council – 2025 budget Public delegations

November 27: Special Council – 2025 budget amendments

January 22: Special Council – 2025 budget local boards and shared services