Learn about the foundations of the long-term financing tools in the budget manual.

On this page

Reserves and reserve funds

The City uses reserves and reserve funds for planned capital expenses, strategic objectives, unexpected or extraordinary costs, and to minimize the impact of fluctuations in the operating and capital budgets on the tax levy. They also allow for informal inter-reserve borrowing, which helps the City manage debt levels. The City’s reserves and reserve funds are classified as either obligatory or discretionary. Obligatory reserve funds are created when a provincial statute requires that revenue received for specific purposes is segregated from the general revenues of the municipality. Obligatory reserve funds are to be used solely for the purpose prescribed for them by statute. Discretionary reserve funds are created under the Municipal Act when Council wishes to earmark revenue to finance a future expenditure for which it has the authority to spend money, and to set aside a certain portion of any year’s revenues so that the funds are available as required.

The City currently has almost 80 reserves and reserve funds. A long-term forecast for each of the reserves and reserve funds has been prepared as part of the multi-year budget process. This long-term view helps us understand the flexibility and sustainability of the plan and affordability of the operating and capital budget and forecasts over the long term. The forecast incorporates planned transfers identified under the various funding strategies, any known external grants received, as well as the planned capital and operating expenditures.

Ideally, the reserve balances remain positive over the entire forecast, and meet the target balances and annual transfer levels as outlined in the General Reserve and Reserve Fund Policy, indicating the plans are affordable and sustainable. This policy will be reviewed in 2024 and staff will provide a report to Council in late 2024.

Table 52 presents a summary of the estimated year-end uncommitted balances by reserve or reserve fund grouping. Since some of the reserves and reserve funds are forecast to have negative balances, staff will explore internal borrowing between funds. External borrowing for specific projects as outlined in the Debt strategy is built into the analysis. The debt capacity held for DC projects, however, is not reflected in the reserve fund balances. Staff will continue to review, prioritize, and defer projects to reduce the 10-year capital plan to fit within the available funding and balance the reserves and reserve funds. Staff will present a balanced 10-year forecast to Council through the budget confirmation process. Furthermore, staff will continue to provide a report on the state of the City’s reserves and reserve funds and debt annually.

The total balance of the tax-supported contingency reserves is positive over the 10-year forecast period to 2033. According to the target balances in the General Reserve and Reserve Fund Policy, the minimum balance for tax supported contingency reserves should total $35.4 million. As shown in Table 52, the estimated 2023 year-end balance is $24.1 million, or 69 per cent of the target balance. Budgeted draws on the reserves from 2024 to 2027 will reduce the balance further to $11.0 million in 2027, representing 28 per cent of the target balance. Also noteworthy is that the Tax Rate Operating Contingency reserve, which is included in this grouping, will be overdrawn by end of 2027. To rebuild the contingency reserves, staff will transfer any year-end surpluses to the reserves as a priority (subject to Council approval at each year end).

The balances for the tax-supported corporate capital, non-tax supported capital, and DC reserve funds are also projected to be negative for some of the years in the 10-year forecast period. The negative balances in the tax-supported corporate capital reserve funds are largely driven by the deficits in the Infrastructure Renewal (150) and Growth (156) reserve funds, which are discussed in the Infrastructure Renewal Strategy and the Growth Strategy. Similarly, the deficit balances for the non-tax supported capital reserve funds are a result of the deficits in the Water Capital (152) and Stormwater Capital (165) reserve fund. Staff will be working to further refine the capital program to reduce expenditures to sustainable levels. This work will include reprioritizing projects and will be presented to Council in future budget confirmation processes. With respect to the DC reserve funds, staff are investigating the use of front-ending agreements to finance the projects. As noted in the Debt Strategy, some debt capacity is reserved specifically for DC-funded capital projects, if required.

| Reserve and reserve fund category | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Tax- supported corporate contingency reserves | 24.1 | 17.8 | 14.8 | 12.3 | 11.0 | 11.2 | 11.5 | 11.7 | 12.0 | 12.2 | 12.4 |

| Tax- supported program specific reserves | 16.0 | 15.9 | 15.8 | 14.8 | 14.7 | 15.0 | 15.3 | 15.7 | 16.0 | 16.3 | 16.6 |

| Tax- supported strategic reserves | 5.8 | 4.5 | (2.1) | (2.6) | (3.3) | (3.9) | (4.2) | (3.7) | (2.8) | (1.8) | (5.3) |

| Tax- supported program- specific reserve funds | 3.2 | 2.9 | 2.9 | 3.0 | 3.1 | 3.2 | 3.4 | 3.4 | 3.6 | 3.7 | 3.9 |

| Tax- supported corporate capital reserve funds | 17.3 | (12.2) | (19.9) | (43.8) | (76.6) | (126.9) | (130.9) | (131.9) | (128.7) | (90.2) | (75.5) |

| Non-tax supported contingency reserves | 5.5 | 5.2 | 3.1 | 3.6 | 4.0 | 4.3 | 4.6 | 4.9 | 5.2 | 5.5 | 5.8 |

| Non-tax supported capital reserve fund | 89.4 | 63.5 | 49.9 | 1.2 | 15.2 | (74.6) | (101.6) | (162.6) | (233.8) | (279.8) | (268.4) |

| Obligatory corporate reserve funds | 36.8 | 43.6 | 41.9 | 43.9 | 21.1 | 11.5 | 14.6 | 12.2 | 15.4 | 16.6 | 27.9 |

| Develop- ment charge reserve fund | 21.5 | 37.1 | 61.2 | 31.8 | (93.1) | (118.2) | (110.8) | (76.9) | (109.2) | (82.8) | (48.4) |

| Total | 219.6 | 178.3 | 167.5 | 64.3 | (103.9) | (278.3) | (298.1) | (327.3) | (422.6) | (400.4) | (331.0) |

Actual reserve fund activity and year-end balances for all reserves and reserve funds along with detailed comparison of the balance relative to the target balance are provided to Council in the second quarter of each year.

Debt Strategy

Based on the City’s experience with past borrowing (or debt issuances), staff expect the City will be able to borrow (or issue) a maximum of $50 million in new debt in any year. The analysis and proposals discussed below are developed based on this estimated $50 million annual cap in borrowing. The debt forecast is developed based on a 20-year debt term at 4.5 per cent interest, reflective of current market conditions. The true cap, term, and interest rate will change as the market and economic environment change and the City will need to revisit these assumptions prior to borrowing.

Using our Debt Strategy, the City will borrow money over the period 2025 to 2033 for several purposes. There is debt financing identified for several capital projects that were approved by Council in previous capital budgets that have not been issued yet. In addition, Bylaw (2016) – 20084 contained a provision for a $26.2 million balloon payment in 2026 for police, recreation, and roads debt. This amount will be refinanced in 2026 because the reserve position will not have the capacity to fund projects in the capital budget and forecast and deliver on those balloon payments. New debt financing is proposed for capital projects related to water and transit. Specifically related to Water Services, Council previously approved $21.5 million in reserve funding for the FM Woods Station Upgrade (WT0064) project. Changing this project to be largely debt financed would free up reserve funding for other critical, but less expensive, water projects. Additional costs for the FM Woods Station Upgrade project in this multi-year would also be debt-financed. Finally, debt capacity has been reserved for growth-related development charges (DC) funded infrastructure given the sequencing of City investment ahead of DC collections to enable growth.

Interest rates are higher than in the recent past and the Bank of Canada has indicated that it will continue raising rates until inflation decreases to the policy target i.e., two per cent. As a result, instances of borrowing are proposed to start in 2025. Due to constraints on borrowing, new debt will be prioritized and issued first for any capital projects approved in previous budgets with debt financing, as well as refinancing the balloon payment for By-law (2016) – 20084. Table 53 shows how the new debt will be divided between refinancing existing debt, issuing debt approved by Council in previous budgets, and new debt contained in this capital budget and forecast. It should be noted that this will be monitored and the timing of borrowing may change depending on actual project activity and cash flow accessibility over the forecasted period.

| Description | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|

| Refinance of existing debt | 0.0 | 0.0 | 26.2 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Debt financing approved through previous budgets | 0.0 | 50.0 | 23.9 | 50.0 | 9.2 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Projects approved through 2024 to 2027 MYB | 0.0 | 0.0 | 0.0 | 0.0 | 40.8 | 50.0 | 9.2 | 0.0 | 0.0 | 0.0 |

| Debt capacity reserved for growth projects | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 40.8 | 50.0 | 50.0 | 50.0 |

| Total borrowing | 0.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 | 50.0 |

A list of the projects, timing, and associated costs is provided in Table 54 through Table 56 below.

| Description | Capital project number | Timing | Amount |

|---|---|---|---|

| Guelph Police Services headquarter renovations | PS0033 | 2026 | 9.9 |

| Victoria Road Recreation Centre expansion/renovation | RF0051 | 2026 | 8.0 |

| Clair/Laird and Hanlon interchange | RD0267 | 2026 | 8.2 |

| Total | n/a | n/a | 26.2 |

| Description | Capital project number | Timing | Amount |

|---|---|---|---|

| South End Community Centre construction | RF0093 | 2025 | 40.7 |

| Baker District Redevelopment projects | LB0028 PG0079 SS0025 | 2025 to 2027 | 66.0 |

| Transit facility | GG0252 TC0059 | 2027 | 8.3 |

| Baker District servicing (Cardigan Street) | PN0887 | 2027 | 2.0 |

| FM Woods Station upgrade | WT0064 | 2027 to 2028 | 16.0 |

| Total | n/a | n/a | 133.0 |

| Description | Capital project number | Timing | Amount |

|---|---|---|---|

| FM Woods Station upgrade | WT0064 | 2028 to 2029 | 43.0 |

| Verney Booster Pumping Station upgrades | WT0015 | 2029 | 7.0 |

| Guelph Transit and Fleet Services – Transit Facility | TC0087 | 2029 to 2030 | 50.0 |

| Debt capacity reserved for growth projects | n/a | 2030 to 2033 | 190.8 |

| Total | n/a | n/a | 290.8 |

It is important to note that specific debt related Council approval will be required to borrow the money as outlined above. A bylaw along with a staff report containing detailed background information will be provided to Council before any borrowing is completed.

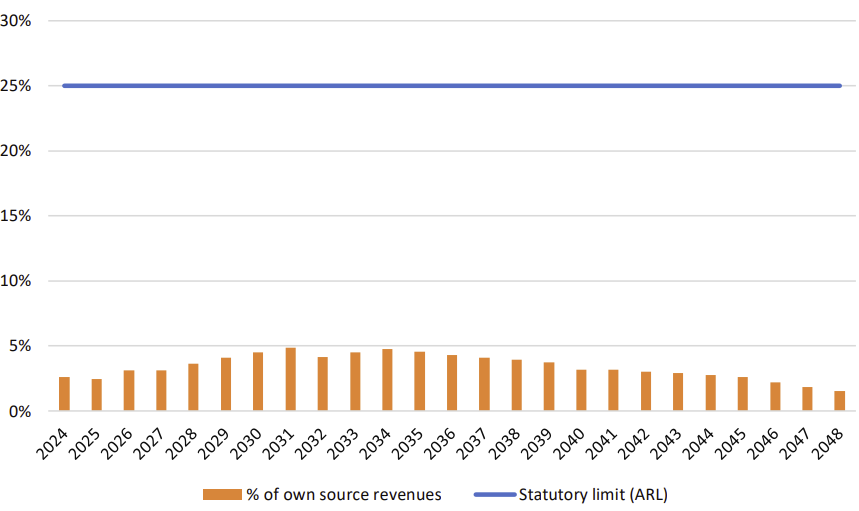

Municipalities are required by legislation to not borrow where the debt servicing costs exceed 25 per cent of own-source revenues, also referred to as the Annual Repayment Limit (ARL). In addition to this legislative requirement, the City also has self-imposed limits that are outlined in the Debt Management Policy.

The City’s planned debt is projected to be within the annual limitations as prescribed by the province (ARL) as well as the limits in the Debt Management Policy. The charts below show the estimated measures relative to the policy maximums. Figure shows the City’s estimated debt servicing costs as a percentage of projected own source revenues are well below the ARL.

Figure 8: Debt servicing costs as a percentage of own-source revenue

View Figure 8 data

| Year | Statutory limit (ARL) | % of own source revenues |

|---|---|---|

| 2024 | 25% | 3% |

| 2025 | 25% | 2% |

| 2026 | 25% | 3% |

| 2027 | 25% | 3% |

| 2028 | 25% | 4% |

| 2029 | 25% | 4% |

| 2030 | 25% | 4% |

| 2031 | 25% | 5% |

| 2032 | 25% | 4% |

| 2033 | 25% | 4% |

| 2034 | 25% | 5% |

| 2035 | 25% | 5% |

| 2036 | 25% | 4% |

| 2037 | 25% | 4% |

| 2038 | 25% | 4% |

| 2039 | 25% | 4% |

| 2040 | 25% | 3% |

| 2041 | 25% | 3% |

| 2042 | 25% | 3% |

| 2043 | 25% | 3% |

| 2044 | 25% | 3% |

| 2045 | 25% | 3% |

| 2046 | 25% | 2% |

| 2047 | 25% | 2% |

| 2048 | 25% | 2% |

Related pages

City budget

Previous annual budgets

Budget manual

Budget Policy

Watch and listen

Mayoral direction

Latest updates

Guelph’s 2025 Tax levy finalized

January 22, 2025

Some City rates and fees changing January 1

December 23, 2024

City of Guelph confirms 2025 budget

November 27, 2024

Mayor announces final update to proposed 2025 budget

November 14, 2024

Mayor Guthrie invites public to attend town hall meetings to discuss 2025 budget

October 28, 2024

Mayor Guthrie shares draft 2025 budget update

October 17, 2024

Council adopts Guelph’s 2024-2027 Multi-Year Budget

November 29, 2023

City of Guelph releases first four-year budget

November 3, 2023

Timeline

October 11: Council education – Building our City budget.

November 3: Guelph’s 2024 -2027 Multi -Year Budget released

November 7: Special Council – 2024-2027 Multi-Year Budget

November 15: Special Council – 2024-2027 Public delegations

November 22: Council workshop – 2024-2027 Multi-Year Budget

November 29: Special Council – 2024-2027 budget amendments