Read Mayor Guthrie’s Introduction to the 2025 Budget Update arrow_forward

Accessibility information.

Budget summary

On November 29, 2023, Council adopted Guelph’s first four-year multi-year budget (MYB), covering the years 2024 to 2027. The 2025 budget confirmation is Guelph’s first confirmation year in this four-year MYB cycle. The budget confirmation process, which includes reviewing, updating, and confirming the budget, is the mechanism for readoption in the City’s Budget Policy.

In November 2023, Guelph’s 2025 budget was initially approved with a tax levy increase of 9.80% compared to 2024. On February 28, a Mayoral Direction was released directing staff to prepare an update to the adopted 2025 budget with a property tax impact of no more than four per cent, split proportionately between the City and local boards and shared services (LBSS) agencies.

The 2025 budget confirmation process focused on prioritization of the City’s needs to balance moving strategic priorities forward with affordability pressures; this process included both new investments proposed in the 2025 adopted budget, as well as existing services in the base budget. This year, for the first time, the City services and Local Boards and Shared Service (LBSS) agencies’ budgets will be considered separately. This separation helps to align the processes with updated budget legislation, with the City services portion of the budget following the Strong Mayor process, and LBSS budgets being presented to Council for approval in alignment with the pre-Strong Mayor budget process. LBSS agencies will present their 2025 budget updates to Council for approval on January 22, 2025, after the City’s budget is formally adopted. The following budget information relates to the City portion only and will be updated following the approval of the LBSS agencies’ budgets in January 2025.

To bring forward a 2025 budget update in line with the Mayoral Direction, the City’s tax-supported budget is capped at no more than a 2.63 per cent increase over 2024, requiring a $15.5 million dollar reduction from the City’s portion of the previously-adopted 2025 budget.

To achieve this, staff developed a prioritization framework to assess the criticality of service delivery and budget decisions for 2025. This process varied slightly between the operating and capital budget, each of which are detailed in the operating and capital sections of this website.

The overriding themes that emerged from the development of the 2025 budget update included:

- Prioritizing housing by advancing investments that enable and service growth.

- Investing in maintaining City assets in a state of good repair to support uninterrupted delivery of high priority services.

- Striving for affordability for the community by prioritizing new investments and existing services using the same set of criteria

Guelph’s 2025 draft budget update reflects these themes, and accomplishes several objectives:

- Meets the affordability target set out in the Mayoral Direction on budget.

- Presents a fully funded 10-year capital budget and forecast that enables the City to meet its part of the Housing Pledge and maintain high priority assets.

- Leverages existing grant opportunities and leaves space for future grants to help mitigate tax increases.

- Significant investment in revitalizing the downtown.

- Continued progress on environmental goals through ongoing investment in transit, electrification, and active transportation, which is partially advanced through a reduction in tax support for parking.

Key takeaways

- The proposed capital budget and forecast takes a long-term view, maximizing reserve and debt capacity. It relies heavily on inter-reserve fund borrowing in the earlier years, and staff will continue to pursue grant opportunities as they arise to bolster that forecast.

- The timing of development charge collections and exemptions are uncertain, and legislated exemptions and discounts continue to put pressure on the tax supported capital reserve forecast.

- The debt forecast stays well within legislated limits and City policy targets, but will exceed S&Ps threshold, making a future credit rating reduction likely. Debt capacity has been reserved after 2030 to support potential development charge collection delays.

- Interest rates are decreasing, so the strategy of delaying debt issuances for previously approved projects to begin in 2025 continues to make sense.

- There is no capacity to add or increase tax-supported capital projects without an offsetting reduction or increase to capital funding.

- Tax-supported capital funding is a constraint to accelerating progress on integrated corridor reconstruction projects, which are funded from taxes, rates, and development charges.

- While inflation overall is returning to the Bank of Canada’s target range, the Non-Residential Building Construction Price Index (NRBCPI) is still higher than normal which impacts the capital budget and forecast.

Future Guelph Strategic Plan

Implementation of the Future Guelph Strategic Plan remained an important factor in determining priorities for the 2025 confirmation budget. However, as the City balances progress toward Council’s objectives with affordability pressures, the pace of implementation in some areas has slowed. Through the budget process, further prioritization within the Future Guelph Strategic Plan occurred, and focused on areas of the plan tied to housing, affordability, accountability, and core infrastructure renewal. Delivery of action items related to non-core infrastructure, and optional programs and services were scaled over a longer implementation period.

The following provides more details related to investments and impacted initiatives as part of the 2025 budget:

Foundations

- Progress towards the development of a People and Culture Plan will continue, but over a longer period than originally planned.

- A centralized data management platform will support accountability through improved data security, Strategic Plan reporting, and the ability to make data-driven decisions.

- Infrastructure Renewal was prioritized as part of the review of the 10-year capital budget. Assets associated with higher risks and those directly associated with new housing development were maintained in the budget, while others were pushed further outside the 10-year timeframe. This will support continued delivery of high priority services, while lower priority services could experience interruptions resulting from asset condition.

- While providing excellent customer service remains a priority, some aspects of the Service Simplified Strategy, such as centralization of all customer service functions, will be implemented over a longer timeframe.

- To support digital service options, improvements of some foundational IT systems are moving forward at a slower pace, including both the Customer Relationship Management and Records Management systems.

City Building

- Policy work that supports initiatives across the housing continuum, investments towards quicker development application review, and infrastructure that directly enables new housing starts have all been prioritized within the budget.

- Implementation of the Recreation, Culture and Trail Master Plans have been slowed as part of capital reprioritization, which may reduce the City’s ability to increase attraction to parks and amenities in the short term.

- The opening of Baker District Library and South End Community Centre are on track and expected to open in late 2026.

- Implementation of the Guelph Transit Future Ready Action Plan will continue at a slower pace, which may result in missing ridership targets in the immediate future. New federal government funding for transit has been announced, and the pace of transit expansion will be revisited as part of the 2026 budget confirmation process after more information is provided.

- Exploration of new transportation technologies will be limited to support the focus on housing enabling infrastructure.

Environment

- Continued investment in fleet and transit electrification will support the continued reduction of Guelph’s carbon footprint.

- Progress on implementation of some actions in the climate adaptation plan and investments in circular economy initiatives have been slowed, and timelines associated with the Urban Forest Management Plan implementation have been expanded.

- Investment in stormwater management is focused on the highest risk areas across the city, and investment in lower risk areas have been deferred.

- Community outreach efforts related to environmental programs – water reduction initiatives in particular – have been reduced.

People and Economy

- There are continued investments in paramedic services to support the City in meeting its response time targets.

- Investment for downtown streetscaping was increased to reflect Council’s September 2024 decision on the Downtown Infrastructure Renewal Plan, inclusive of underground waste bins and a self-cleaning washroom.

Operating budget investment

The budget is the tool that generates the revenue needed to fund the cost of delivering services to the community. These revenues are generated through both property taxes and user rates.

The property tax revenue increases to support the City’s share of the budget update are detailed in Table 1.

| Levy type | 2025 adopted | 2025 update | 2026 forecast | 2027 forecast | 2028 Forecast |

|---|---|---|---|---|---|

| Tax levy – City service | 7.16% | 2.59% | 4.77% | 4.59% | 3.56% |

| Tax levy – Guelph General Hospital (GGH) | 0.23% | 0.23% | 0% | (0.22%) | 0% |

The net impact of the 2025 Budget Update is outlined in Table 2, by City department. Building upon the 2024 adopted budget, Table 2 identifies the 2025 base budget increase. This includes inflationary increases, adjustments for historical trends and the 50 per cent phase-in of staffing investments from 2024. Service recommendations are City investments categorized as operating impacts from capital, growth, service enhancement, service reduction or capital funding. Assessment growth revenue is budgeted at 1.15 per cent of the base budget in 2025. Assessment growth revenue is allocated proportionately between the City and LBSS agencies, with 67 per cent distributed to the City. Finally, the Guelph General Hospital levy sits outside of the City tax target.

Details surrounding the base budget and the various service recommendation categories are provided in the operating budget.

| City department | 2024 adopted budget | 2025 base budget | 2025 base budget change % | 2025 service recommendations | 2025 total budget | 2025 net change | 2025 tax levy impact | |

|---|---|---|---|---|---|---|---|---|

| Mayor | 529,990 | 16,560 | 3.12% | (26,600) | 519,950 | (1.89%) | (0.00%) | |

| Council | 839,970 | 24,790 | 2.95% | 42,500 | 907,260 | 8.01% | 0.02% | |

| Chief Administrator’s Office Administration | 940,502 | 23,050 | 2.45% | (38,000) | 925,552 | (1.59%) | (0.00%) | |

| Strategic Initiatives & Intergovernmental Services | 6,020,763 | 638,429 | 10.60% | (206,550) | 6,452,642 | 7.17% | 0.13% | |

| Finance | 3,356,019 | 274,449 | 8.18% | 28,068 | 3,658,536 | 9.01% | 0.09% | |

| Infrastructure, Development and Environment Administration | 454,140 | 16,180 | 3.56% | 0 | 470,320 | 3.56% | 0.00% | |

| Planning and Building Services | 5,387,565 | 220,291 | 4.09% | 207,149 | 5,815,005 | 7.93% | 0.13% | |

| Facilities and Energy Management | 5,237,472 | 430,370 | 8.22% | (38,207) | 5,629,635 | 7.49% | 0.12% | |

| Engineering and Transportation Services | 7,146,978 | 270,696 | 3.79% | (18,582) | 7,399,092 | 3.53% | 0.08% | |

| Environmental Services | 15,147,814 | 713,555 | 4.71% | (2,156,618) | 13,704,751 | (9.53%) | (0.44%) | |

| Economic Development and Tourism | 2,685,630 | 121,794 | 4.54% | 0 | 2,807,424 | 4.54% | 0.04% | |

| Public Services Administration | 703,610 | 8,213 | 1.17% | 0 | 711,823 | 1.17% | 0.00% | |

| Parks | 12,827,056 | (62,396) | (0.49%) | (352,674) | 12,411,986 | (3.24%) | (0.13%) | |

| Culture and Recreation | 9,513,515 | 511,851 | 5.38% | 107,868 | 10,133,234 | 6.51% | 0.19% | |

| Guelph Transit | 27,991,341 | (89,734) | (0.32%) | (51,767) | 27,849,840 | (0.51%) | (0.04%) | |

| Operations | 19,384,905 | 1,006,037 | 5.19% | (69,760) | 20,321,182 | 4.83% | 0.29% | |

| Guelph-Wellington Paramedic Services | 10,151,659 | (96,134) | (0.95%) | 391,332 | 10,446,857 | 2.91% | 0.09% | |

| Fire Services | 31,155,917 | 920,056 | 2.95% | (18,050) | 32,057,923 | 2.90% | 0.28% | |

| Corporate Services Administration | 585,160 | 20,540 | 3.51% | 0 | 605,700 | 3.51% | 0.01% | |

| Human Resources | 3,241,540 | 147,198 | 4.54% | 0 | 3,388,738 | 4.54% | 0.05% | |

| Information Technology | 5,170,799 | 173,767 | 3.36% | 52,042 | 5,396,608 | 4.37% | 0.07% | |

| City Clerk’s Office | 1,760,490 | (119,564) | (6.79%) | 80,000 | 1,720,926 | (2.25%) | (0.01%) | |

| Strategic Communications & Community Engagement | 2,741,864 | 521,988 | 19.04% | (138,355) | 3,125,497 | 13.99% | 0.12% | |

| Legal and Court Services | 1,281,995 | (147,015) | (11.47%) | 139,233 | 1,274,213 | (0.61%) | (0.00%) | |

| Internal Audit | 317,588 | (34,790) | (10.95%) | 0 | 282,798 | (10.95%) | (0.01%) | |

| General expenses and revenues | (411,060) | 1,177,013 | (286.34%) | 532,579 | 1,298,532 | (415.90%) | 0.53% | |

| Reserve Funding | 38,605,447 | (1,017,947) | (2.64%) | 6,781,006 | 44,368,506 | 14.93% | 1.77% | |

| Affordable Housing | 100,000 | 0 | 0 | 0 | 100,000 | 0 | 0.00% | |

| Total City service impact | 212,868,669 | 5,669,247 | 2.66% | 5,246,614 | 223,784,530 | 5.13% | 3.36% | |

| Less: Assessment Growth Revenue | (2,501,967) | 0 | 0.00% | 0 | (2,501,967) | 0.00% | (0.77%) | |

| Total 2025 City budget impact | 210,366,702 | 5,669,247 | 2.69% | 5,246,614 | 221,282,563 | 5.19% | 2.59% | |

| Guelph General Hospital Levy | 750,000 | 0 | 0.00% | 0 | 750,000 | 0.00% | 0.23% | |

The median residential property value for a single-family detached home in 2024 is $408,000. From a property tax bill perspective, the payment for the City portion of property taxes over the four-year period is estimated in Table 3, below.

| Levy type | 2025 adopted | 2025 update |

|---|---|---|

| 2024 annual tax – median residential property | $4,759.90 | $4,759.90 |

| Annual City service tax increase over prior period | $340.81 | $123.28 |

| Annual Guelph General Hospital tax increase over prior period | $10.95 | $10.95 |

| Annual local boards and shared services increase over prior period | $114.71 | To be determined |

These estimates are based on 2024 assessed values and 2024 tax policy and will change annually as updated assessment values are available.

The City’s non-tax supported budget is comprised of stormwater services, water services, wastewater services, parking services, Ontario Building Code Administration (OBCA) and court services. The gross impact of the 2025 budget update to the City’s non-tax-supported services are outlined in Table 4.

| City department | 2024 adopted budget | 2025 base budget | 2025 base budget change % | 2025 service recommendations | 2025 total budget | 2025 net change |

|---|---|---|---|---|---|---|

| Ontario Building Code | 6,655,045 | 16,560 | (19.8%) | 161,200 | 5,500,805 | (17.3%) |

| Stormwater | 12,449,740 | 24,790 | 6.8% | 1,229,443 | 14,528,214 | 16.7% |

| Water | 35,855,563 | 23,050 | 4.7% | 1,123,461 | 38,677,643 | 7.9% |

| Wastewater | 38,788,228 | 638,429 | 5.0% | 1,075,953 | 41,792,230 | 7.7% |

| Parking | 3,987,518 | 274,449 | 14.9% | 24,717 | 4,605,328 | 15.5% |

| Court Services | 5,526,600 | 16,180 | 3.7% | 522,200 | 6,252,200 | 13.1% |

| Total non-tax-supported investment | 103,262,694 | 220,291 | 3.8% | 4,136,974 | 111,356,420 | 7.8% |

The overall increase to the utility rate supported services (water, wastewater, and stormwater) for the average residential customer is outlined in Table 5.

| Rate type | 2025 adopted $ millions | 2025 adopted rate impact | 2025 update $ millions | 2025 update rate impact |

|---|---|---|---|---|

| Rate – City services | 8.2 | 10.21% | 4.4 | 5.36% |

The average three-person household consumes 180 cubic meters in a year and has an average impervious area of 188 square meters. The residential rate impacts to the average residential bill are identified Table 6.

| Description | 2025 Adopted | 2025 Update |

|---|---|---|

| Increase to the average residential household per month | $9.17 | $4.82 |

Capital budget investment

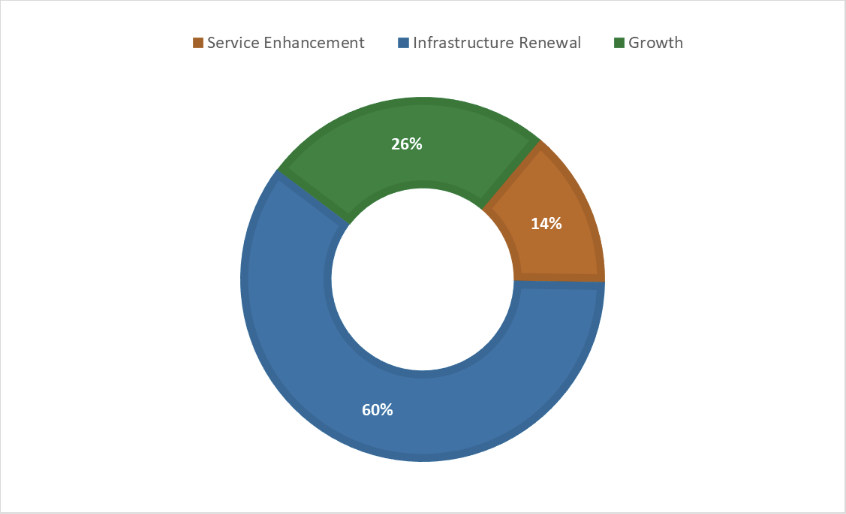

From a capital perspective, the City is projected to spend $2.3 billion over the next ten years with $1.09 billion in the next four years. This work can be categorized into three drivers: infrastructure renewal, growth, and service enhancement. Infrastructure renewal remains the largest focus, followed by growth-related capital investment supporting the mandated requirement for our population to grow to over 200,000 people by 2051, Figure 1.

Figure 1 2025 capital budget update investment by category over the 10-year budget:

| Capital budget category | Total 2025 capital budget update investment – 10-year ($ millions) |

|---|---|

| Service enhancement | 329.0 |

| Infrastructure renewal | 1,396.4 |

| Growth | 600.6 |

From an investment by year perspective, the capital budget can be quite variable as the size and complexity of projects each year can be vastly different, demonstrated in Table 7.

| Year | Annual capital budget investment |

|---|---|

| 2025 adopted | 227.2 |

| 2025 update | 197.5 |

The capital budget is funded by various revenue sources, highlighted in Table 8.

| Funding source | 2024 adopted | 2025 adopted | 2025 update |

|---|---|---|---|

| Grants and subsidies | 14.6 | 23.3 | 30.8 |

| Development charges | 47.2 | 75.7 | 61.4 |

| Rate funding | 65.7 | 63.4 | 43.7 |

| Rate funded debt | 7.8 | 4.0 | 4.0 |

| Tax funding | 62.6 | 54.6 | 45.5 |

| Tax funded debt | 0.0 | 0.0 | 5.7 |

| Other | 3.8 | 6.2 | 6.4 |

| Total capital funding | 201.7 | 227.2 | 197.5 |