On this page

City Building is a tax-supported funding strategy that finances whole or parts of strategic investments that enhance the City’s current service levels. Enhancing service levels beyond what is or will be delivered to the growing population, typically means increasing funding for that service.

Investment can be through operating or capital budgets, and in most cases combines the two. Typically, the initial investment for City Building requires purchase or construction of capital assets, and those assets require increased operating costs and ongoing maintenance costs. Many times, a project is a combination of many funding strategies including portions funded from growth, infrastructure renewal and City Building funds.

For example, expanding the Guelph Transit bus fleet beyond what is required for a growing population, to achieve higher modal split means buying new buses, construction of a larger Transit operations facility and other associated support infrastructure. A large per cent of the overall transit expansion is considered City Building, with the majority covered by the Investing in Infrastructure Canada Program (ICIP) Transit Stream funding. There is a significant growth component to the investment as well, so a portion of the capital funding comes from development charges. As a result of this expansion there are new operating costs required to operate each additional bus (e.g., fuel, maintenance, operator, route planning and ultimately its replacement) which will require an increase in operating funding for Guelph Transit. A portion will be managed within new property tax assessment growth, but an additional amount will mean an increase in the tax levy beyond current levels.

This is an evolving funding strategy and staff is attempting to provide Council with transparency when they are making service level changes through capital budget decisions. Consistency in approach across all departments is the focus as significant projects/plans are presented to Council.

Strategic City Building Investment priorities

The City of Guelph has several competing service enhancement needs that require Council to prioritize from a fiscal affordability lens as part of the 2022/23 Budget. To assist Council with the prioritization process, staff have considered these service enhancements through the lens of the Strategic Plan metrics, the year and sequencing of these investments needed to meet Strategic Plan goals, as well as the impact of these decisions on our service delivery partners. The outcome of this process is the ranked priority listing that follows, the description of these investments, the risks or outcomes of not providing the funding, and the tax levy implications.

Strategic City Building Investment required

The Strategic City Building Investments consist of both capital and operating funding requirements; in some cases, because base City Building capital funding exists, they have been included in the recommended budget. Any impacts not associated with base City Building capital funding are shown as an investment requirement in Table 1.

Table 1: City Building Investment requirement

| Investment (in thousands) | 2022 | 2023 | 2024 | 025 |

|---|---|---|---|---|

| Operating investment | $3,999 | $1,353 | $1,614 | $2,594 |

| FTEs | 24.4 | 16.3 | 17 | 25.3 |

| Capital investment | $1,565 | $0 | $0 | $1,800 |

| Total investment | $5,564 | $1,353 | $1,614 | $4,394 |

| Tax levy impact | 2.10% | 0.49% | 0.55% | 1.41% |

Operating investment

The operating investment identified above is a combination of impacts from capital investment and non-capital related operating investment. The most significant portion is for FTEs required to carry out the enhanced services, including transit drivers, paramedics, and other professional staff depending upon the priority. Also included here is funding for operating expenses related to fuel, maintenance and purchased goods. In the case where the investment is one-time in nature, there is an ability for Council to utilize reserves as a funding option.

Capital investment

About four per cent of the 2022 to 2031 capital budget and forecasted is City Building investment, or $90.7 million. This figure is an estimate at a point in time and will likely change as capital projects within the capital forecast are designed and timing is confirmed. For example, staff are currently investigating alternative approaches related to the downtown streetscaping enhancements and given timing of available information, this is upwards of $46 million that has not been included in the budget forecast at this time.

The City currently has available $4.75 million of base City Building funding that is increasing over time due to Council’s approval of past strategies including most recently as part of the 2021 budget, the approval of a $1.0 million (0.39%) increase in contribution, phased in over 2023 and 2024 to fund the City Building portion of the Baker District Central Library. However, the total base funding requirement now, for all known projects, is $8.74 million leaving an annual gap of about $3.99 million.

Table 2 shows the allocation of the current $4.64 million in base annual City Building funding.

Table 2: Allocated City Building funding

| Strategy | Time Period | |

|---|---|---|

| Baker District | $1,550,000 | 25 years |

| South End Community Centre Public Art | $40,000 | 10 years |

| Investment in digital services and customer service | $541,000 | 10 years |

| City facility investment and Operations Campus | $605,000 | 25 years |

| Guelph Trail Master Plan (GTMP), Urban Forest Management Plan (UFMP) and Open Space | $775,000 | 20 years |

| Active Transportation Network (ATN) including Cycling Master Plan | $1,125,000 | 20 years |

| Total | $4,641,000 | not available |

To offset some of this impact, the contributions from the phasing in of the operating impacts of South End Community Centre and Baker District redevelopment are being recommended to be directed to the City Building Reserve Fund, providing $7.5 million in one-time funding. If there is a change from the staff proposal, this will impact the City Building investment requirement.

The culmination of the funding gap is demonstrated by the forecasted position of the City Building Reserve Fund which is currently projecting a deficit of $34.2 million at the end of 2031. Council will need to increase funding or defer projects into future years to eliminate this funding gap over time.

Strategic City Building Investment details (in priority ranking)

1. Investment in digital services and customer service

If the City could buy software to solve its customer service challenges, it would. But technology is only part of what’s required to improve customer service and experiences.

Before purchasing another technology solution, the City must address the challenges associated with its service delivery model. That is, the problems created when individual departments design and deliver services separately.

Until the reviews and redesigns services based on customer needs (not the departments delivering those services) any investment in a corporate customer service platform will fall short of expectations or fail.

A strategic and sustainable investment is needed to support a more customer focused, performance driven, digitally enabled workplace. Only then will the City achieve the service, performance, and financial benefits of digital service transformation.

Based on experiences in other cities, the fastest and most effective approach to digital service transformation involves a dedicated team with expertise in user research, service design, customer service and experience, web and digital. That team ensures services are designed for successful customer interactions online, by phone and in person.

This requires new staff resources including the hiring of a Program Manager, Customer Service and Customer Service Analyst in 2022 (replacing currently identified temporary positions funded from reserves from 2022 through 2024) that will implement Service Simplified and support implementation of recommendations from the Service Rationalization Report by:

- Establishing, measuring and reporting on customer service performance—in all departments, in all channels

- reviewing City services based on user needs

- optimizing the processes to deliver those services

- using data to continue making improvements on service delivery

Key digital projects in 2022/23 include building the business case for 311/Customer Relationship Management (CRM), replacing the corporate cash management system with a unified payment platform, implementation of a human resource information system, upgrading Building Services systems, expanding use of digital forms and upgrades to current tools such as appointment bookings.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent increase in service/customer satisfaction

- Creation of a Digital Services Team that leads customer and digital service improvements

- Implement the Service Simplified Strategy and related initiatives in the Digital and Technology Master Plan

- Implement fibre optic network initiative

Outcome if not approved or deferred to future year:

- One temporary position will remain in budget funded from reserves from 2022 through 2024, limiting progress on customer service improvements. The City would continue developing and begin implementing employee training, customer service performance measurement and reporting. But would not have as much capacity to review, redesign and redeploy services. Likely impact would mean customer service delivery and experience remains status quo but not advance at a pace that customers, residents, and businesses have come to expect and in the way they experience with other private and public sector organizations. Customer satisfaction will likely remain the same, then decrease as people and businesses expect more customer focused and digitally enabled services.

- The permanent resources in 2022 will ensure immediate action on:

- Planning a business case for a corporate Customer Relationship Management (CRM).

- Implementing initiatives shared between Service Simplified and the Digital and Technology Master Plan.

- Identification and review of customer service processes for continuous improvement projects.

- Elimination of departments buying or building their own separate service platforms, halting the number of separate systems IT will be expected to manage and support.

- Specifically, the following capital projects in 2022/23 Budget may be deferred to 2024 or beyond if funding is not maintained and/or approved:

- IT0052 Information Technology Enhancements

- IT0060 Enterprise Reporting and Dashboards

- PN2439 CMMS Implementation

Current investment

This priority has $541,000 of base City Building funding allocated to it over 12 years and associated operating impacts from these projects have been included in the budget including: $1,126,375 (2022), $1,140,520 (2023), $232,140 (2024), $16,800 (2025). Table 3 below shows the additional investment required to fully implement the requirements as proposed.

Table 3: Requested Investment in digital services and customer service

| Investment (in thousands) | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Operating investment | $87.2 | $180.5 | $(87.2) | $(180.5) |

| FTEs | 2 | not available | not available | not available |

| Capital investment | not available | not available | not available | not available |

| Total investment | $87.2 | $180.5 | $(87.2) | $(180.5) |

| Tax levy impact | 0.03% | 0.07% | (0.03)% | (0.07)% |

Council approved the investment in digital services and customer service as outlined above.

2. Paramedic Services Master Plan

The Paramedic Service Master Plan proposes enhancing resources in 2022 through 2025 to meet the predicted increases in call volumes and service demands. City staff continue to take all measures possible to ensure that resources are being used as efficiently and effectively as possible to reduce response times and provide excellent service, but additional staffing will be required. The 2022 budget includes four new paramedics and associated costs that will enable an additional ambulance shift of 12 hours per day, seven days per week. The future steps included in the budget forecast include the appropriate supervisory oversight and clerical support staff required to maintain appropriate service. The Paramedic Service continues to operate a growing Community Paramedicine program funded by the Province. One of the goals of this program is to mitigate pressures of increasing response volumes, while better meeting the needs of patients and area residents.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent increase in response time based on the Canadian Triage and Acuity Scale

- Enhancing Guelph’s collaborative relationship with the County

Outcome if not approved or deferred to future year:

- Paramedic response times are reported to Council in June, and as reported the Paramedic Service generally met the response time targets set by Council in 2020. Current trending suggests that the call volume in 2021 will be about nine per cent higher than in 2020, with the increase expected to continue into 2022. With these increases, response times can be expected to fall below the set targets in 2022 without staffing enhancements. Response times have an impact on patient outcome including, in the most critical emergencies, to patient survival. Worsening response times caused by increasing call volumes will have a direct negative impact on the residents of Guelph and Wellington County.

Current investment

There is currently no capital City Building investment required for this priority. Table 4 below shows the additional operating investment required.

Table 4: Requested investment in Paramedic Services Master Plan

| Investment (in thousands) | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Operating investment | $384.8 | $24.2 | $(170.2) | $375.2 |

| FTEs | 4.0 | 2.0 | not available | 4.0 |

| Capital investment | not available | not available | not available | not available |

| Total investment | $384.8 | $24.2 | $(170.2) | $375.2 |

| Tax levy impact | 0.15% | 0.01% | (0.06%) | 0.12% |

Council approved the Paramedic Services Master Plan as outlined above and leveraged the Tax Rate Operating Contingency Reserve to manage the impact of the Provincial funding being delayed by one year on new budget approvals.

3. Community Benefit Agreement expansion – Guelph Humane Society (GHS)

The GHS advocates for animals through care, education, community support, protection and leadership. Through the Community Benefit Agreement (CBA) renewal process, additional funding has been identified by GHS. As a higher dollar value increase, this request is presented separately to address demand for education, outreach and animal welfare. Additionally, to the CBA, the GHS will continue the Provincially mandated service for animal control (or pound services) on behalf of the municipality. Through services, including adoption, education and community initiatives, animal and pound services, rescue of wildlife and more, GHS protects and cares for animals while offering a dependable service. GHS arranged over 750 adoptions, cared for 1,280 sick or orphaned wild animals and was inspired by over 275 volunteers. Further, the CBA identifies objectives and measures aligning to the City’s Strategic Plan, with annual reporting back to Council.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent of citizens expressing a sense of belonging

Outcome if not approved or deferred to future year:

- As the only animal services provider in Guelph, GHS is positioned to meet the needs of municipal pound services, educational and outreach initiatives and care to animals and wildlife. Without an increase, some programs and supports will stop. There is risk to operations of the municipal pound services without support through the CBA‘s educational investment.

Current investment

There is currently no capital City Building investment required for this priority. Table 5 below shows the additional operating investment required.

Table 5: Requested investment in CBA for Guelph Humane Society

| Investment (in thousands) | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Operating investment | $150.0 | not available | not available | not available |

| FTEs | not available | not available | not available | not available |

| Capital investment | not available | not available | not available | not available |

| Total investment | $150.0 | not available | not available | not available |

| Tax levy impact | 0.06% | 0.00% | 0.00% | 0.00% |

Council approved the Community Benefit Agreement Expansion for the Guelph Humane Society as outlined above.

4. Community Benefit Agreement expansion – Guelph Neighbourhood Support Coalition (GNSC)

The GNSC is a network of neighbourhood groups that come together to share information, provide support, distribute funding resources and advocate for community issues. Through the CBA renewal process, additional funding has been identified. As a higher dollar value, this request is presented separately to address increased activities and programs in the community and newly emerging anti-racism, equity and inclusion programs. Imbedded in 15 neighbourhoods across the city, GNSC focuses it’s work with marginalized and opposed people and communities to amplify voices and create spaces to participate and access programs. Annually, GNSC offers 350 no cost programs, services and events for almost 70,000 residents along with impacting (and including) over 1200 volunteers. Further, the agreement with the City identifies objectives and measures aligning to the City’s Strategic Plan, with an annual reporting back to Council.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent of citizens expressing a sense of belonging

- Complete the Community Plan Refresh, Coalition of Inclusive Municipalities Action Plan to ensure that the City delivers equity in service delivery and policy

Outcome if not approved or deferred to future year:

- GNSC evolves with changing community need. Beyond the pandemic, GNSC responds to increased community need for food, financial support, childcare, diversity and acceptance. They will implement the work of their Values Charter. Without a funding increase, some programs and supports will stop.

Current investment

There is currently no capital City Building investment required for this priority. Table 6 below shows the additional operating investment required.

Table 6: Requested investment in Guelph Neighbourhood Support Coalition CBA

| Investment (in thousands) | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Operating investment | $246.6 | not available | not available | not available |

| FTEs | not available | not available | not available | not available |

| Capital investment | not available | not available | not available | not available |

| Total investment | $246.6 | not available | not available | not available |

| Tax levy impact | 0.04% | 0.05% | 0.00% | 0.00% |

Council approved the Community Benefit Agreement Expansion for the GNSC as outlined above with a transfer from the Tax Rate Operating Contingency Reserve in 2022 of $150,000 to phase the tax levy impact in over two years.

5. Cultural Heritage Action Plan implementation

To provide additional resources to deliver the heritage planning program due to identified capacity issues. City Council passed a motion on January 14, 2021 requesting “That further heritage resources be identified for Council consideration within the 2022 budget.” The approval of the Cultural Heritage Action Plan requires additional staff resources to deliver the council approved actions. Changes to the Heritage Act and the Planning Act have strict timeframes for review, which strains existing resources. To meet legislative timeframes additional people resources are required, one Heritage Planner FTE in 2022 and a second in 2025. This investment will support conservation of heritage through the implementation of the Cultural Heritage Action Plan, improved customer service for owners of homes listed on the municipal register or within heritage conservation districts, reduce processing response times of development applications where heritage review is required and will allow for enhanced community engagement and education/outreach on heritage conservation.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent reduction of climate risk exposure for the City’s built and natural assets

Outcome if not approved or deferred to future year:

- Prolonged implementation of Cultural Heritage Action Plan could lead to loss of heritage assets in the community

- Frustration in the community with the City’s processing timelines for development applications, building permits and heritage permits

- Increased pressure on staff to process permits and respond to inquiries without adequate time to review

Current investment

There is currently no capital City Building investment required for this priority. Table 7 below shows the additional operating investment required. Table 6 below shows the additional investment required to fully implement this strategy (noting that this includes a temporary position in 2022 that reverses in 2024).

Table 7: Requested investment in Cultural Heritage Action Plan implementation

| Investment (in thousands) | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Operating funding | $496.6 | $(257.4) | $(123.4) | $122.9 |

| FTEs | 1.0 | not available | not available | 1.0 |

| Capital funding | not available | not available | not available | not available |

| Total | $496.6 | $(257.4) | $(123.4) | $122.9 |

| Tax levy impact | 0.19% | (0.09%) | (0.04%) | 0.04% |

Council approved the Cultural Heritage Action Plan Implementation as outlined above.

6. City facility investment and Operations Campus

This investment supports the construction of the new Operations Campus as well as interim support for existing City operational facilities to ensure they continue to function while meeting accessibility and operational changes. The largest portion is related to the required increase in size of the facilities to meet current standards, which puts the costs above those allowed by Development Charge legislation. The age of current facilities is the primary driver of the need for replacement, the secondary requirement to expand to meet current best practices and provide for future growth needs is driving the need for City Building funding support. A portion of this funding supports investment City facilities related to accessibility and operational improvements required to meet legislative requirements and enhance overall efficiency.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent of current assets that provide satisfactory levels of service

- Per cent of citizens expressing a sense of belonging to Guelph

- Employee engagement index

- Percent increase in renewable energy resources

- Percent reduction in greenhouse gas emissions

- Build key assets – Operations Campus

Outcome if not approved or deferred to future year:

- Accessibility improvements to current facilities could not be done at the pace required to ensure our community has equitable access to service.

- the construction of new facilities would be built at a size not appropriate for current practices, under-sizing the facilities would lead to inefficiency in service delivery and potential impact to external citizen satisfaction from City services.

- Specifically, the following capital projects in 2022/23 Budget may be deferred to 2024 or beyond if funding is not maintained and/or approved:

- GG0269 Accessibility Improvements

- WC0022 Transfer Station

- WC0034 Cart Washing and Cart Storage Building

Current investment

This priority has $605,000 of base City Building funding allocated to it over 25 years for City facility improvement and accessibility requirements and associated operating impacts from these projects of $40,000 have been included in the 2023 budget.

Additional capital funding for the Operations Campus is required starting in 2026 at an annual amount of $950,000 for a period of 25 years and the operating impacts from these expanded facilities are still in development and not included in the budget forecast at this time.

Council did not make any adjustments to this strategic investment.

7. Guelph Trail Master Plan (GTMP), Urban Forest Management Plan (UFMP) and Open Space

The investment in this program supports enhanced services within the Open Spaces of the City, this includes trail enhancements through the GTMP and expansion of the tree canopy through the UFMP. Additional funding is required to adapt amenities at existing parks to meet changing needs of the community, as well as additional equipment to support the maintenance and operation of existing open spaces.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent reduction of climate risk exposure for City’s built and natural assets

- Per cent change in non-auto mode share

- Per cent reduction in greenhouse gas emissions

- Connectivity index

- Per cent of citizens expressing a sense of belonging in Guelph

- Develop and implement and economic development and tourism strategy

Outcome if not approved or deferred to future year:

- Extending the implementation timeline for the GTMP, UFMP and open space enhancements over a longer time period results in a delay in achieving the outcomes envisioned.

- Alternative option to lower the annual investment, which would defer the programs, however, if approval of other level of government grant funding is received, advance these projects as quickly as possible within available staffing capacity.

- Specifically, the following capital projects in 2022/23 Budget may be deferred to 2024 or beyond if funding is not maintained and/or approved:

- PK0125 City-wide Trails Enhancements

- PO0028 Trail Replacement and Upgrade

- PO0040 Parks Operation Equipment

- PO0043 1 Ton Trucks

Current investment

This priority has $750,000 of base City Building funding allocated to it over 20 years to fund the capital investment and associated operating impacts from these projects included in the budget are $204,100 (2022), $296,200 (2023), $429,600 (2024), $76,700 (2025). There is no additional investment required at this time.

Council did not make any adjustments to this strategic investment.

8. Active Transportation Network (ATN) including Cycling Master Plan

This grouping of capital investment is intended to implement the City’s approved ATN Plan (2017), Cycling Master Plan (2013) and Sidewalk Needs Assessment Study (2017). These investments are critical to achieving Guelph’s goals of ensuring the transportation network is safe, equitable, sustainable, complete, affordable and supportive of land use. Investment in this grouping of projects is also critical to providing healthy living opportunity for the community.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent reduction of climate risk exposure for City’s built and natural assets

- Per cent reduction in greenhouse gas emissions

- Per cent change in non-auto mode share

- Per cent reduction in collision severity

- Connectivity index

- Per cent of citizens expressing a sense of belonging in Guelph

- Develop and implement aa community road safety strategy

- Develop and implement the Transportation Master Plan

Outcome if not approved or deferred to future year:

- Without sufficient funding, the pace at which projects will be implemented will be slowed, potentially leading to missed opportunities to align with overall road reconstruction projects. A portion of the funding for these projects is from the Investing in Canada Infrastructure Program and could be lost by 2028 if City funding contribution is not available.

- Extending the implementation timeline n of the ATN Program over a longer time period will result in a delay in achieving the outcomes envisioned.

- Specifically, the following capital projects in 2022/23 Budget may be deferred to 2024 or beyond if funding is not maintained and/or approved:

- PO0033 Recreation Trails Renewal – Active Transportation

- RD0357 Cycling Network Expansion (ICIP-GUE-05)

- RD0382 Stone Road W Multi-Use Path Hanlon Road to Edinburgh

- RD0387 Cycling Network Expansion – Snow Removal/Street Sweeping Equipment

- RD0392 Sustainable Transportation Programs

Current investment

This priority has $1,125,000 of base City Building funding allocated to it over 20 years to fund the capital investment and associated operating impacts from these projects included in the budget are $320,100 (2022), $11,400 (2023), $63,900 (2024), $105,500 (2025).

Additional funding for this priority is required starting in 2026 at an annual amount of $525,000 for a period of 20 years.

Council did not make any adjustments to the above strategic investment.

9. Transit Route Review and other transit digital investment

This investment increases ridership over 13 years to 10.4 million, which equates to an increase of 4.29 million in ridership by 2034 or a mode share of 13 percent by 2031. There are many social, environmental, and economic benefits to investment in transit, both direct and indirect. These benefits include providing transit as a mobility service to ensure equitable access to essential destinations; fewer traffic fatalities per capita, particularly for vulnerable road users; and fewer greenhouse gases produced that aids in carbon footprints as well as reducing the risk of disease and premature death related to air pollution. This investment aligns with the Transportation Master Plan’s values of being safe, equitable, complete, sustainable, affordable, and supportive of land use through creating a more connected route network with increased service frequency. These changes support the proposed transit priority measures in the Transportation Master Plan, to achieve a Quality Transit Network. The Transportation Master Plan project team has reviewed the Transit Action Plan report and is supportive of the recommendations made.

The installation of digital signs will provide real time bus arrival information for customers at main transit hubs and bus shelters. The digital signs can be used to provide real time service alerts on cancellations, delays, and detours. Real bus arrival information is essential for all riders, especially customers who do not have access to a cell phone with data to access arrival information.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent change in non-auto mode share

- Per cent reduction in greenhouse gas emissions

- Connectivity index

- Per cent increase in service/customer satisfaction

- Per cent of citizens expressing a sense of belonging in Guelph

- Continue to implement the electrification of the fleet and personal vehicles

- Develop and implement the Transportation Master Plan

- Develop the Connectivity Index and support regional transit connectivity

- Increasing digitization of services

Outcome if not approved or deferred to future year:

- Increased transit mode share, as recommended by Transportation Master Plan, will not be possible

- Ridership lost from Covid-19 will not be recovered at same pace

- A delay in implementation of the proposed plan, will likely mean a forfeiting of the associated ICIP Transit Stream grant funding each year of delay, pending outcomes of negotiations.

- If the Route Review is delayed, there are still 13 full-time and one part-time positions required between 2022 and 2025. Nine of these positions are part of the outcome of the 2019 council approved Service Review recommendation to stabilize the workforce. Two supervisors are required to achieve the industry best practice of supervisor to operator ratio. One Transit Planner to study, design, evaluate and implement long-term strategies for Transit. One trainer to provide licensing for Transit operators and on-going recertification.

- Sustainability goals will not be achieved at the same pace

- Phase 1 of digital signs has already been approved and is in the initial stage to hire a consultant to scope the work for digital signs. If phase 2 is not approved, there will not be enough funds to implement the project

- Customer expectations and experience are negatively impacted

- Specifically, the following capital projects in 2022/23 Budget will be deferred to 2024 or beyond if funding is not approved:

- TC0064-004 Route Review – Year 2

- TC0064-010 Route Review – Year 3

- TC0071 Terminal Upgrades and Expansion (ICIP-GUE-02)

- TC0072 Digital Signs

Current investment

Currently, there is no base City Building funding available for this priority. This priority does include $430,755 (2022), $132,600 (2023), $279,900 (2024), $17,510 (2025) in the current operating budget related to minor capital investment not covered by the Route Review above. Table 8 provides the additional funding required to fully implement this strategy, including the associated 100RE capital funding needed for the electrification of the expanded bus fleet.

Table 8: Requested investment for Transit Route Review and other service enhancements

| Investment (in thousands) | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Operating investment | $1,765.3 | $1,257.7 | $1,897.5 | $2,115.5 |

| FTEs | 17.4 | 13.3 | 16.0 | 20.3 |

| Capital Investment $715,000 of capital transfer is for City Building and $850,000 is for 100 RE | $1,565.0 | not available | not available | not available |

| Total investment | $3,330.3 | $1,257.7 | $1,897.5 | $2,115.5 |

| Tax levy impact | 1.26% | 0.45% | 0.65% | 0.68% |

Council approved the Transit Route Review strategic investment as outlined above.

10. Business Service Agencies Agreements

This request is to address the current under-funding of Guelph’s business service agencies by the City, when compared to other communities, which impacts the agencies’ abilities to deliver critical programs to the local business community. The City is not the sole provider of all services required by businesses; many services are offered through a network of providers funded in part by local government. The City contributed one-time, in-year funding in 2020 as approved by Council, with the intention of establishing longer-term agreements to formalize sustainable service provision to Guelph businesses that help achieve the City’s strategic goals. The servicing agreements will help fund services that include consulting, market research, referrals, mentorship for female, BIPOC, student, circular economy and small businesses, and more.

Strategic Plan KPI improvements and strategic initiatives:

- Number of new circular businesses and collaborations

- Per cent of businesses reporting Guelph as a good place to do business

- Develop and implement Economic Development and Tourism Strategy

Outcome if not approved or deferred to future year:

- Fewer business services/limited opportunities for services that are targeted to Guelph’s strategic priorities.

- Decrease in business retention: increase in businesses closing and the associated job losses, and/or relocating to communities where greater support is more readily available.

Current investment

There is currently no capital City Building investment required for this priority. Table 9 below shows the additional operating investment required.

Table 9: Requested investment for Economic Development Servicing Agreements

| Investment (in thousands) | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Operating investment | $300.0 | not available | not available | |

| FTEs | not available | not available | not available | not available |

| Capital investment | not available | not available | not available | not available |

| Total investment | $300.0 | not available | not available | |

| Tax levy impact | 0.11% | 0.00% | 0.00% | 0.00% |

Council did not discuss this strategic investment as part of the 2022/23 multi-year budget. Council approved an ongoing annual investment of $300,000 as part of the 2023 budget confirmation.

11. Downtown Infrastructure Renewal Streetscape upgrades

As the City seeks to reconstruct essential infrastructure in downtown such as roads, water pipes and sewers, the costs of streetscaping needs to be incorporated in long term financial planning. Presently the streetscaping concepts are provided in the 2014 Downtown Streetscaping Manual. As the pre-construction planning work occurs over the next few years, including completion of Environmental Assessments, city staff will be reviewing the streetscaping elements and costs to ensure expected service levels are included in the detailed designs.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent change of non-auto mode share

- Per cent of citizens expressing a sense of belonging to Guelph

- Develop and implement Economic Development and Tourism Strategy

Outcome if not approved or deferred to future year:

- Staff are reviewing alternative options to this investment, to make a recommendation to Council. There are several influences that have changed the downtown environment since the approval of the DSM in 2014, and it’s appropriate to pause and consider if changes are required. Due to the age of both underground and surface infrastructure within the downtown, replacement is scheduled over the next decade, delaying streetscape improvements until after the underground work is completed would increase costs as well as duplicate impacts to citizens and businesses.

Current investment

There is currently no funding included in either operating or capital to support this priority. Additional funding for the implementation of the strategy as currently estimated would require $1,800,000 annually for 25 years to complete this strategy.

Council did not make any adjustment to this strategic investment.

12. Emerging Transportation Technology Office

Two full-time analysts are requested to support Strategic Plan initiatives under the Navigating our Future priority. Specifically, beginning in 2021, the Strategic Plan calls for establishment of an Emerging Transportation Technologies Office (ETTO) and development of a Connectivity Index (CI). These analysts will work to establish the ETTO and CI with support from senior management. Once established, the ETTO and CI will allow the City to be agile and proactive with rapidly evolving transportation trends (preparing for autonomous vehicles, e-scooters, etc.,), proactively prepare and advocate for connectivity related initiatives (e.g., projects related to interregional transportation), and measure and report against the CI. This work will inform future work plans and budgets and align with the Transportation Master Plan.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent change of non-auto mode share

- Establish an Emerging Transportation Technology Office

- Develop and implement the Transportation Master Plan

- Develop the Connectivity Index and support regional transit connectivity

- Per cent of businesses reporting Guelph as a good place to do business

Outcome if not approved or deferred to future year:

- Limited ability to adapt quickly in a rapidly evolving sector, particularly in terms of disruptive and sustainable technology. This will impact Guelph’s journey in terms of delivering on the Transportation Master Plan and in its smart city evolution. Not proceeding will also limit Guelph’s ability to respond to new funding opportunities, project requests, pilot projects, and other innovation related works.

Current investment

There is currently no investment in this priority included in the proposed budget. Table 10 provides the additional funding required to fully implement this strategy. This is the gross cost, there is potential for revenue offset from Red Light Cameras and Automated Speed Enforcement.

Table 10: Requested investment for Emerging Transportation Technology Office

| Investment (in thousands) | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Operating investment | not available | $103.0 | $97.0 | not available |

| FTEs | not available | 1.0 | 1.0 | not available |

| Capital investment | not available | not available | not available | not available |

| Total investment | not available | $103.0 | $97.0 | not available |

| Tax levy impact | 0.00% | 0.04% | 0.03% | 0.00% |

Council did not discuss the emerging technologies office strategic investment.

13. Community Investment – subsidy pilot program

The annual review of the Subsidy Program (the Affordable Bus Pass, Fee Assistance in Recreation and Animal Licensing) explores barriers that residents face across the programs. It was identified that programs may not be affordable to those in the greatest financial need, but a funding mechanism was not available to support a program change. At the June 2021 Council Meeting, Council moved that a one-year multi-tier sliding scale pilot of the Affordable Bus Pass be presented for consideration as part of the 2022 budget. A one-year pilot ensures a change in the program is consistent and fair, ensures ease of access to residents and protects the dignity of participants. A pilot helps support those in further need along with fiscal accountability, data collection and detailed reporting.

The proposed pilot included three-tiers of income below the Low Income Cut-Off (LICO) measure that would apply to the Affordable Bus Program for 2022, where approved applicants within the three income tiers would be eligible for monthly bus passes at rates of $4 (95% discount), $20 (75% discount), or $37.50 (53% discount), be considered in the 2022 budget.

Strategic Plan KPI improvements and strategic initiatives:

- Per cent of citizens expressing a sense of belonging

- Complete the Community Plan Refresh, Coalition of Inclusive Municipalities Action Plan to ensure that the City delivers equity in service delivery and policy

Outcome if not approved or deferred to future year:

- To some individuals, the subsidy rates within these programs are still not affordable or attainable. Adjustments to the program support more community members with dignity and pride, in this case, to have access to public transit. Without, many would just not have the flexibility to move around.

Current investment

There is currently no investment in this strategy included in the proposed budget. Table 11 provides the additional funding required to fully implement this strategy. This is the gross cost, as it is a pilot it could be funded from Operating Contingency Reserve as a one-time expense.

Table 11: Requested investment for Subsidy Pilot Program

| Investment (in thousands) | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Operating investment | $385.0 | $(385.0) | not available | not available |

| FTEs | not available | not available | not available | not available |

| Capital investment | not available | not available | not available | not available |

| Total investment | $385.0 | $(385.0) | not available | not available |

| Tax levy impact | 0.00% | (0.00)% | 0.00% | 0.00% |

Council approved the Community Investment – subsidy pilot program with no impact to the net tax levy as Council funded from the Tax Rate Operating Contingency reserve.

2023 confirmed budget

Paramedic Services Master Plan

As part of the 2023 confirmation review process, staff recommended the advancement of the four proposed paramedics from 2025 to 2023, in addition to the previously approved investment of paramedic resources included in the 2022 and 2023 approved budget. Additional paramedic resources were provided during the height of the pandemic through the Ministry of Health transfer payment for COVID-19 expenses. At the time of budget confirmation, it was not known if the grant will continue for the 2023 fiscal year but the resource investment is needed. If provincial funding is not continued, the City portion of $417,780 would be funded by a transfer from the Tax Rate Operating Contingency Reserve and the County of Wellington would fund $245,360. In 2024 the Ministry of Health would provide funding for 50 per cent of the investment, with the City and the County sharing the remaining 50 per cent.

Table 12: Requested advancement of the Paramedics Master Plan from 2025 to 2023

| Investment (in thousands) | 2023 update | 2024 | 2025 |

|---|---|---|---|

| Operating investment | $663.1 | $0 | not available |

| FTEs | 4 | not available | not available |

| Capital investment | not available | not available | not available |

| Total investment | $663.1 | $0 | not available |

| Tax levy impact | 0.00% | 0.07% | 0.00% |

Council approved the advancement of the Paramedic Services Master Plan as outlined above.

Business Service Agencies Agreements

In 2022, an investment was proposed to address the current underfunding of Guelph’s business service agencies (see 10 above). This strategic investment was not discussed as part of the multi-year budget, however, a motion to fund this investment was passed during the 2023 budget confirmation resulting in the approval of a $300,000 annual investment for Guelph’s business service agencies, equivalent to a 0.11 per cent increase to the tax levy in 2023.

Capital prioritization

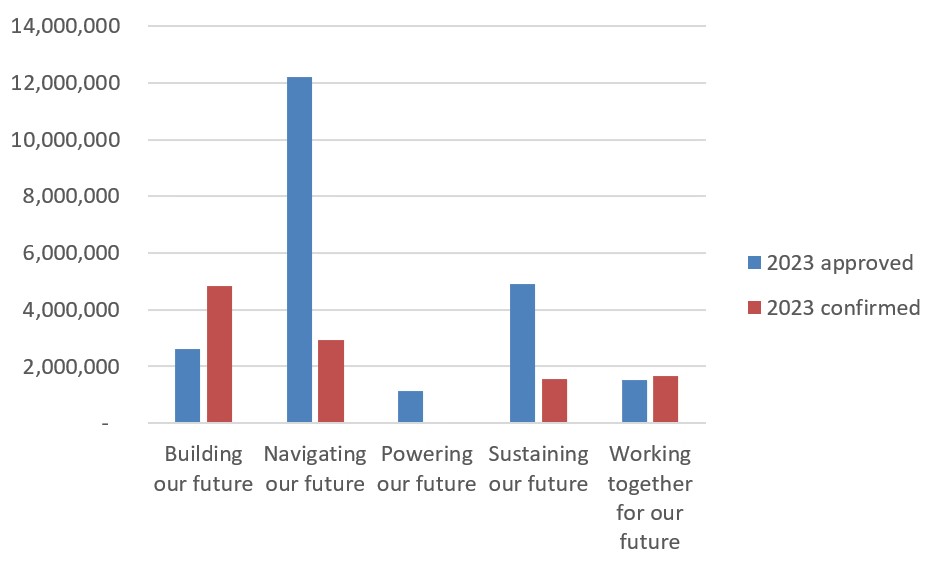

In accordance with the methodology outlined in Report 2022-118 Inflationary Financial Impact Strategy, staff completed a holistic review of the approved 2023 capital budget. This capital prioritization resulted in a decrease of $11.4 million in City building projects moving forward in 2023 compared with what was previously approved for the 2023 capital budget. The majority of these changes were in the “Navigating our future” pillar. Individual project changes are presented in the 2023 budget dashboard.

Figure 1 – 2023 City building budget by strategic pillar:

View Figure 1 data

| Strategic pillar | 2023 approved | 2023 update |

|---|---|---|

| Building our future | $2,600,300 | $4,822,300 |

| Navigating our future | $12,221,550 | $2,924,500 |

| Powering our future | $1,150,000 | not available |

| Sustaining our future | $4,920,000 | $1,570,000 |

| Working together for our future | $1,506,500 | $1,673,600 |