On this page

The 2022/23 budget is a reflection of the resources required to meet our service delivery requirements to both our current and future population: residents and businesses. Further, it includes a number of strategic investment options required to implement the Strategic Plan priorities and demonstrate improvement on the Council-approved performance metrics. The budget is the tool for setting the pace of achieving these goals through demonstration of the operating budget financial impact over a four-year period.

Overriding themes and strategies have emerged from the development of the 2022/23 Budget and will be reinforced through all aspects of the presentation and documents:

- long-term financial planning provides the foundation to inform data driven decisions, to prioritize investment aligned with capacity to delivery and to maintain an affordable pace of service delivery

- the COVID-19 Pandemic recovery continues to create uncertainty in future with changing business needs, supply chain challenges, significant inflationary concerns and reliance on Provincial grant funding

- digital transformation is needed to become the modern and customer-centric City our community expects

- Climate change is happening around us and the City is responding by applying a climate lens across everything we do including capital lifecycle replacements, new construction, and energy optimization initiatives.

- Not only is legislation mandating that Guelph grows, but it’s also changing a number of our businesses operating landscapes; the multi-year budget enables an agile forecast to plan and respond to these changes

The total 2022/23 operating expenditure budget is $485.6 million and $506.1 million respectively; investment is focused on maintaining service delivery to our current and growing population. The 2022 and 2023 capital budgets total $141.4 million and $161.9 million respectively, and primarily focus on infrastructure renewal of our aging assets and building infrastructure to support our growing City.

Overall, the key achievements included in the City’s multi-year budget investment are:

- Just under 15km of fibre-optic cabling installed readying the City for future data and network needs.

- Investing in renewable energy to fund the electrification of 35 aged conventional transit fleet buses over eight years, significantly reducing the City’s carbon footprint.

- Delivery of 10 trail connectivity solutions throughout 2022 and 2023.

- Improved completion time (6 to 12 months) of low/medium priority forestry work versus current two-year timeline.

- Planting of 10,000 trees in each of 2022 and 2023, in partnership with our local stakeholders.

- Making our roads safer through implementation of the Community Road Safety Strategy, approval of speed limit reductions, and implementing new technology like red light cameras and automated speed enforcement.

- Recovery of City businesses significantly impacted by COVID including the reimplementation of the transit U-pass contract and planned programming of cultural and recreation facilities.

- City programming of the Guelph Sports Dome expands to multi use, year-round sport and facility access for all ages.

- Delivering more timely processing of development applications and building inspections in accordance with changing legislation.

- Responding to above-average inflationary pressures with the help of the City’s strong reserve position, recognizing the excellence in past efforts to build reserves and focus on cost-containment through COVID.

- Continued focus on maintaining critical City infrastructure to deliver services to the community; implementing the Capital Program Resourcing Strategy which builds people capacity over five years to double the City’s capital spending and project execution in accordance with the Asset Management Plan.

- Responding to our growing community while maintaining our service levels with the addition of a tandem sand/salter truck, a mobility bus and a waste packer.

- Developing business cases where required to assess viability of Service Rationalization Review opportunities.

- Approval of the Transit Route Review which will increase ridership over 13 years to 10.4 million or a mode share of 13 percent by 2031.

- Approval of the 2022/23 Paramedic Services Master Plan resourcing needs to meet the predicted increases in call volumes and service demands.

- Approval of investment in digital services and customer services to assist the City in achieving the service, performance, and financial benefits of digital service transformation.

- Approval of increased Community Benefit Agreement allotments for Guelph Humane Society and Guelph Neighbourhood Support Coalition.

- Approval of Cultural Heritage Action Plan resourcing to address capacity issues and deliver on council approved actions

- Approval of a pilot project for a three-tier subsidy program for transit as well as approval of a “kids ride free” transit program beginning in March.

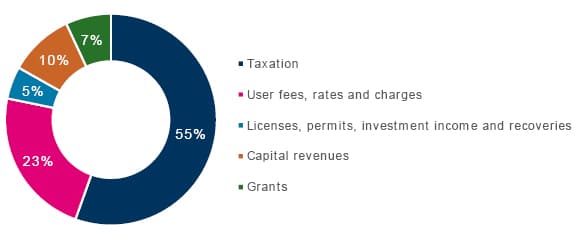

The operating and capital budgets are funded by different revenue streams, including property taxes, user fees, rates, grants, development charges and investment income. The following chart shows the total revenues that fund the combined operating and capital budgets in 2022. Property taxes fund just over half of the City’s budget, meaning other revenue sources are just as important when we consider the delivery of all services.

2022 total revenues by type

| Revenue type | Amount | Percentage |

|---|---|---|

| Taxation | (284,351,153) | 56% |

| User Fees, rates and charges | (115,744,915) | 23% |

| Licenses, permits, investment income and recoveries | (26,523,249) | 5% |

| Capital revenues | (49,384,370) | 10% |

| Grants | (34,167,724) | 7% |

The budget is the tool which is used to generate the required revenue needed to fund the cost of delivering services to the community. The revenue increases for taxes and user rates required to fund the budget over four years are included in the table below. The City also has many user fees and charges that are increasing with inflation and reducing the amount otherwise required from taxation.

| Levy Type | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|

| Tax levy – City | 2.78% | 3.35% | 4.42% | 3.54% |

| Tax levy – Local board and shared services | 1.43% | 1.82% | 1.15% | 1.68% |

| Tax levy – Guelph General Hospital | 0.00% | n/a | 0.25% | n/a |

| Total tax levy increase | 4.21% | 5.17% | 5.82% | 5.22% |

| User rate increase | 2.61% | 2.73% | 3.45% | 2.84% |

Highlights from the 2022/23 budget

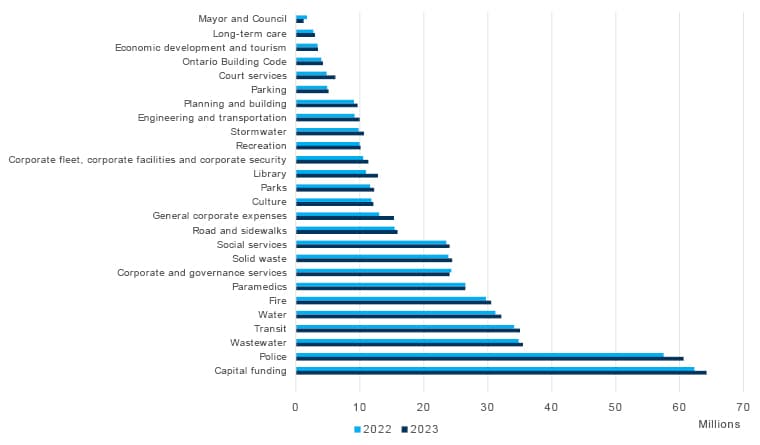

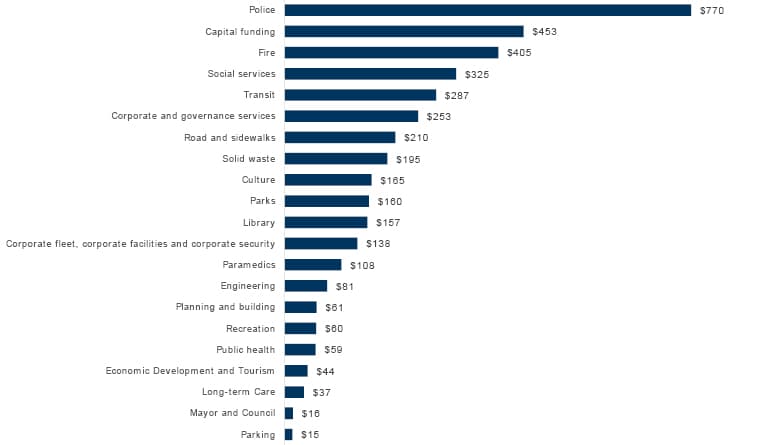

In aggregate, the total cost of each service for 2022 and 2023 shows the total operating investment excluding any revenues. This provides context to the magnitude of each service cost in comparison to each one another, it is not however reflective of the property tax cost. Capital funding as depicted only includes the tax supported businesses, as the City works on improved ways to visualize total cost of service in the future. The water, wastewater, stormwater, courts services, parking services, police, library, long-term care, public health, and social services include the capital cost of service in their respective lines.

2022/2023 gross expenditure by service

| Service | 2022 (in millions) |

2023 (in millions) |

|---|---|---|

| Mayor and Council | 1.17 | 1.20 |

| Long-term care | 2.73 | 2.97 |

| Economic development and tourism | 3.40 | 3.44 |

| Ontario Building Code | 3.95 | 4.20 |

| Court services | 4.77 | 6.14 |

| Parking | 4.98 | 5.12 |

| Planning and building | 9.07 | 9.61 |

| Engineering and transportation | 9.15 | 9.96 |

| Stormwater | 9.80 | 10.6 |

| Recreation | 9.94 | 10.1 |

| Corporate fleet, corporate facilities and corporate security | 10.5 | 11.3 |

| Library | 10.9 | 12.8 |

| Parks | 11.6 | 12.2 |

| Culture | 11.8 | 12.1 |

| General corporate expenses | 13.0 | 15.3 |

| Road and sidewalks | 15.4 | 15.9 |

| Social services | 23.5 | 24.0 |

| Solid waste | 23.8 | 24.4 |

| Corporate and governance services | 24.3 | 24.0 |

| Paramedics | 26.5 | 26.5 |

| Fire | 29.7 | 30.5 |

| Water | 31.2 | 32.1 |

| Transit | 34.1 | 35.0 |

| Wastwater | 34.8 | 35.5 |

| Police | 57.5 | 60.6 |

| Capital funding | 62.3 | 64.2 |

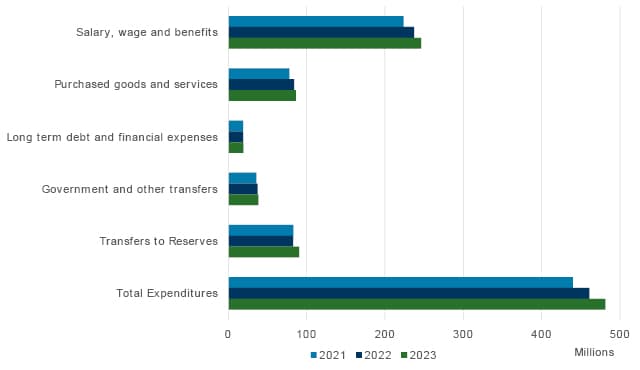

The operating budget can also be considered by type of expense rather than by service. From this perspective, it becomes clear why we value our employees in this organization as they represent the most critical and significant input to delivering the services we provide to the community.

Operating expenses by type

| Year | 2021 | 2022 | 2023 |

|---|---|---|---|

| Salary, wage and benefits | 223,852,924 | 237,333,583 | 246,343,367 |

| Purchased goods and services | 77,996,869 | 84,021,894 | 86,488,409 |

| Long term debt and financial expenses | 18,798,814 | 19,090,350 | 19,265,350 |

| Government and other transfers | 35,971,300 | 37,630,521 | 38,506,641 |

| Transfers to Reserves | 83,069,540 | 82,710,693 | 90,665,990 |

| Total Expenditures | 439,689,447 | 460,787,041 | 481,269,757 |

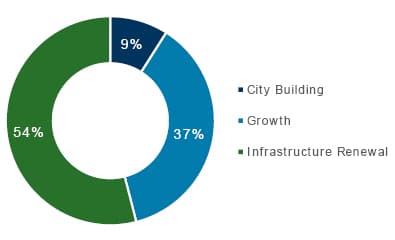

Transitioning to the capital budget, the City is projecting to spend $2.04 billion over the next ten years and this work can be categorized into the following priority areas. Infrastructure Renewal remains the largest focus followed by growth-related capital investment supporting the mandated requirement for our population to grow to over 200,000 people by 2051.

From an investment by year perspective, the capital budget can be quite variable as the size and complexity of projects each year can be vastly different. A new facility for example, can cause a variation in one year over another that is more focused on linear road and underground pipe infrastructure renewal. The City’s integrated infrastructure planning crosses a number of departments and asset management plans drive the majority of capital decisions.

Capital budget investment by year

| Year | Capital budget investment |

|---|---|

| 2022 | 141,423,650 |

| 2023 | 161,907,150 |

| 2024 | 193,632,450 |

| 2025 | 286,120,350 |

| 2026 | 181,305,750 |

| 2027 | 193,362,850 |

| 2028 | 155,080,800 |

| 2029 | 233,826,400 |

| 2030 | 242,787,140 |

| 2031 | 260,475,600 |

Finally, new this year, we wanted to provide a more detailed look at what each service costs to the property taxpayer annually. The average residential property valued at $389,500 is estimated to pay $4,007.47 in property taxes in 2022 based on the approved budget, an increase of $153.77 over 2021 or about $12.81 per month. From a property tax bill perspective, the average homeowner payment is divided as follows:

2022/23 average property tax cost by service

| Service | Percentage | Average cost per service |

|---|---|---|

| Police | 19.2% | $770 |

| Capital funding | 11.3% | $454 |

| Fire | 10.1% | $406 |

| Social services | 8.1% | $326 |

| Transit | 7.2% | $288 |

| Corporate and governance services | 6.3% | $253 |

| Road and sidewalks | 5.3% | $211 |

| Solid waste | 4.9% | $195 |

| Culture | 4.1% | $165 |

| Parks | 4.0% | $160 |

| Library | 3.9% | $157 |

| Corporate fleet, corporate facilities and corporate security | 3.4% | $138 |

| Paramedics | 2.7% | $109 |

| Engineering | 2.0% | $81 |

| Planning and building | 1.5% | $62 |

| Recreation | 1.5% | $61 |

| Public health | 1.5% | $59 |

| Economic Development and Tourism | 1.1% | $44 |

| Long-term Care | 0.9% | $38 |

| Mayor and Council | 0.4% | $16 |

| Parking | 0.4% | $15 |

2022 gross expenditures and funding sources (thousands)

Operating funding

| Funding source | Funding |

|---|---|

| Taxation | 286,644.7 |

| User fees | 115,893.0 |

| Product sales/licence | 7,514.0 |

| Interest and penalties | 8,023.8 |

| External recoveries | 11,216.5 |

| Grants | 34,167.7 |

| Reserve transfers | 22,206.9 |

| Total operating funding | 485,666.6 |

Capital funding

| Funding source | Funding |

|---|---|

| Grants and subsidies | 16,379.9 |

| Development charges | 24,829.7 |

| Rate funding | 54,889.9 |

| Tax funded | 43,367.5 |

| Other | 1,963.7 |

| Total capital funding | 141,430.7 |

Expenditures by pillar

| Pillar | Operating expenditures | Capital expenditures | Total gross expenditures |

|---|---|---|---|

| Building our Future | 258,762.8 | 27,168.1 | 285,930.9 |

| Navigating our Future | 43,218.3 | 34,067.3 | 77,285.6 |

| Powering our Future | 17,903.4 | 1,750.0 | 19,653.4 |

| Sustaining our Future | 127,305.6 | 72,607.2 | 199,912.8 |

| Working Together for our Future | 38,476.5 | 5,838.1 | 44,314.6 |

| Gross expenditures | 485,666.6 | 141,430.7 | 627,097.3 |

2022/23 proposed budget to approved and 2024/25 proposed forecast to approved forecast

Table 1: Net levy requirement and impact 2022 to 2025 – printer friendly

Proposed budget

| Proposed budget | Net levy requirement $ | 2022 Levy impact | 2023 Net levy requirement $ | 2023 Levy impact | 2024 Net levy requirement $ | 2024 Levy impact | 2025 Net levy requirement | 2025 levy impact |

|---|---|---|---|---|---|---|---|---|

| 2021 Net Levy | 265,092,613 | n/a | 279,719,226 | n/a | 296,975,450 | n/a | 316,481,493 | n/a |

| 2022 Proposed Budget Increase | 12,982,554 | 4.90% | 14,953,834 | 5.35% | 17,364,343 | 5.85% | 17,239,996 | 5.45% |

| Assessment Growth | (3,470,000) | (1.31%) | (2,797,192) | (1.00%) | (2,969,755) | (1.00%) | (3,164,815) | (1.00%) |

| Net Property Tax Levy and Payment in Lieu of Taxes | 274,605,167 | 3.59% | 291,875,868 | 4.35% | 311,370,039 | 4.85% | 330,556,674 | 4.45% |

Budget changes – from proposed

| Changes | Net levy requirement $ | 2022 Levy impact | 2023 Net levy requirement $ | 2023 Levy impact | 2024 Net levy requirement $ | 2024 Levy impact | 2025 Net levy requirement | 2025 Levy impact |

|---|---|---|---|---|---|---|---|---|

| Reduce City Building funding for digital services and customer service Strategy | (109,000) | (0.04%) | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Reduce Transfer to Capital Growth Reserve Fund | (500,000) | (0.19%) | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Phase-in Strategic City Building Investment to fund the Guelph Neighbourhood Support Coalition | (150,000) | (0.06%) | 150,000 | 0.05% | n/a | 0.00% | n/a | 0.00% |

| Increase hourly parking rate from $2.18 to $2.66 per hour | (93,100) | (0.04%) | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Reduce Library budget increase | (100,000) | (0.04%) | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Apply the excess growth assessment | (500,000) | (0.19%) | 500,000 | 0.18% | n/a | 0.00% | n/a | 0.00% |

| Reduce the phase-in budget for Baker District and South End Community Centre | (500,000) | (0.19%) | n/a | 0.00% | 500,000 | 0.17% | n/a | 0.00% |

| Pilot program for kids free transit | 125,000 | 0.05% | (125,000) | (0.04%) | n/a | 0.00% | n/a | 0.00% |

| Pilot program for kids free transit reserve funding | (125,000) | (0.05%) | 125,000 | 0.04% | n/a | n/a | n/a | n/a |

| A one-time investment for the Welcoming Streets Program | 91,000 | 0.03% | (91,000) | (0.03%) | n/a | 0.00% | n/a | 0.00% |

| Welcoming Streets Program reserve funded | (91,000) | (0.03%) | 91,000 | 0.03% | n/a | n/a | n/a | n/a |

| A one-time investment for the Court Support Worker | 50,000 | 0.02% | (50,000) | (0.02%) | n/a | 0.00% | n/a | 0.00% |

| Court Support Worker reserve funded | (50,000) | (0.02%) | 50,000 | 0.02% | n/a | n/a | n/a | n/a |

| PIN Network volunteer check | 120,000 | 0.05% | (120,000) | (0.04%) | n/a | 0.00% | n/a | 0.00% |

| PIN Network volunteer check funded from reserve | (120,000) | (0.05%) | 120,000 | 0.04% | n/a | n/a | n/a | n/a |

| Minimum wage absorbed through gapping | (130,000) | (0.05%) | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Co-op Students for planning | 80,000 | 0.03% | (80,000) | (0.03%) | n/a | 0.00% | n/a | 0.00% |

| Co-op Students for planning funded from reserve | (80,000) | (0.03%) | 80,000 | 0.03% | n/a | 0.00% | n/a | 0.00% |

| Parking user fees increase of 5% to be exclude Norwich and Arthur | 2,000 | 0.00% | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Library funding added back | 99,999 | 0.04% | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Reduce transfer to contaminated sites | (500,000) | (0.19%) | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Paramedic Master Plan | 384,800 | 0.15% | 24,200 | 0.01% | (170,200) | (0.06%) | 375,150 | 0.12% |

| Paramedic Master Plan funded from reserve | (192,400) | (0.07%) | 192,400 | 0.07% | n/a | n/a | n/a | n/a |

| Emerging Technologies Office – Analyst | 0 | 0.00% | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Transit – Route Review Operating Impacts | 3,331,360 | 0.67% | 1,257,690 | 0.45% | 1,897,500 | 0.64% | 2,115,500 | 0.67% |

| Community Investment – Subsidy Program Pilot | 385,000 | 0.15% | (385,000) | (0.14%) | n/a | 0.00% | n/a | 0.00% |

| Funded from Tax Contingency Reserve | (385,000) | (0.15%) | 385,000 | n/a | n/a | n/a | n/a | n/a |

| Cultural Heritage Action Plan Resourcing FTE | 116,600 | 0.04% | (2,400) | (0.00%) | n/a | 0.00% | 122,900 | 0.04% |

| Cultural Heritage Action Plan Resourcing | 380,000 | 0.14% | (255,000) | (0.09%) | (123,400) | (0.04%) | n/a | n/a |

| Cultural Heritage Action Plan Resourcing funded from reserve | (380,000) | (0.14%) | 255,000 | 0.09% | 125,000 | 0.04% | n/a | n/a |

| Community Investment – CBA increase GNSC | 246,600 | 0.09% | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Community Investment – CBA – Guelph Humane Society | 150,000 | 0.06% | n/a | 0.00% | n/a | 0.00% | n/a | 0.00% |

| Information Technology enhancements | 87,200 | 0.03% | 180,500 | 0.06% | (87,200) | (0.03%) | (180,500) | (0.06%) |

| Approved budget | 279,719,226 | 5.52% | 296,975,450 | 6.17% | 316,481,493 | 6.57% | 336,154,539 | 6.22% |

| Less assessment growth | (3,470,000) | (1.31%) | (2,797,192) | (1.00%) | (2,969,755) | (1.00%) | (3,164,815) | (1.00%) |

| Total approved property tax levy and payment in lieu of taxes (By-Law) | 279,719,226 | 4.21% | 296,975,450 | 5.17% | 316,481,493 | 5.57% | 336,154,539 | 5.22% |

| Guelph General Hospital outside of levy | 750,000 | 0.28% | 750,000 | 0.28% | n/a | 0.00% | n/a | 0.00% |

| Use reserves for hospital levy | (750,000) | (0.28%) | (750,000) | (0.28%) | 750,000 | 0.25% | n/a | 0.00% |

2023 confirmed budget

In December 2021, Council approved the City’s first multi-year budget (MYB), covering the years 2022 and 2023. The 2023 budget confirmation is the City’s first and only confirmation year in this two-year MYB cycle. The Municipal Act requires that if a municipality passes a MYB, they must “readopt” the budget for every second or subsequent year, either in the year that the budget applies, or in the preceding year. The budget confirmation process, which includes reviewing, updating, and confirming the budget, is the mechanism for readoption in the City’s Budget Policy.

The overriding themes and strategies that emerged from the development of the approved 2023 budget included the COVID-19 pandemic, pace and capacity, changing legislation, modernizing and transforming the way we deliver services, and making energy and climate change reduction impacts. These key themes continue to influence the 2023 budget update. Since the 2023 budget’s creation in 2021, the COVID-19 theme has evolved from local response and recovery to larger global pressures that have informed additional themes that underlie the 2023 confirmed budget:

- Significant pricing challenges related to inflation on the acquisition of goods and services, are impacting both the operating and capital budgets.

- Supply chain challenges are causing longer than normal lead times resulting in delays in deliveries, as well as increased prices of inputs, products and supplies.

- The emerging competitive post-pandemic labour market is causing labour shortages across many of the City’s departments.

- Higher interest rates implemented by the Bank of Canada to combat inflation may result in the economic decline in 2023.

Operating budget

Adjustments were made to the operating budget in alignment with the City’s Budget Policy within the following categories:

- In-year Council approvals

- Legislative changes

- Other 2023 updates

The total confirmed 2023 operating expenditure budget is $509.2 million.

2023 confirmed gross operating expenditures and funding sources ($ thousands)

| Expenditures | 2023 approved budget | 2023 confirmed budget | 2023 change |

|---|---|---|---|

| Salary, wage and benefits | 250,268.2 | 254,833.2 | 4,564.9 |

| Purchased goods and services | 87,659.0 | 88,159.9 | 500.9 |

| Long term debt and financial expenses | 19,265.4 | 19,264.7 | (0.8) |

| Government and other transfers | 38,858.2 | 39,806.2 | 948.0 |

| Transfers to reserves | 110,123.1 | 107,088.2 | (3,034.9) |

| Total expenditures | 506,173.9 | 509,152.1 | 2,978.2 |

| Funding source | 2023 approved budget | 2023 confirmed budget | 2023 change |

|---|---|---|---|

| Taxation | 304,050.9 | 302,958.0 | (1,092.9) |

| User fees | 121,110.5 | 121,489.9 | 379.4 |

| Product sales/license | 7,759.5 | 7,756.8 | (2.7) |

| Interest and penalties | 8,025.1 | 5,394.4 | (2,630.7) |

| External recoveries | 11,416.9 | 12,378.1 | 961.2 |

| Grants | 33,974.5 | 34,504.5 | 530.0 |

| Transfers from reserves | 19,836.4 | 24,670.4 | 4.834.0 |

| Total operating funding | 506,173.9 | 509,152.1 | 2,978.2 |

2023 increase in net payments in lieu and property taxes to be levied

Change from 2022 to 2023 approved net property taxes and payments in lieu.

| Item | 2023 approved net levy requirement ($) | 2023 approved net levy impact |

|---|---|---|

| 2022 net levy | 279,280,030 | n/a |

| 2023 approved budget increase | 17,256,224 | 6.17% |

| Assessment growth | (2,797,192) | (1.00%) |

| Net property tax and payments in lieu of taxes to be levied | 14,459,032 | 5.17% |

Adjustments to approved 2023 budget included in 2023 confirmed budget

In-year Council approvals

| In-year council approvals | 2023 confirmed levy requirement ($) | 2023 confirmed levy impact |

|---|---|---|

| Municipal Accommodations Tax | 171,910 | 0.06% |

| Municipal Accommodations Tax, funded from Tourism reserve | (171,910) | (0.06%) |

| Farmer’s Market transition to 10C | 31,436 | 0.01% |

| Farmer’s Market transition to 10C funded from Tax Operating Contingency reserve | (31,436) | (0.01%) |

| Property Assessed Clean Energy (PACE) program, fully funded through Federation of Canadian Municipalities (FCM) grant | 0 | 0.00% |

| Mayor and Council salary | 124,673 | 0.04% |

| Mayor and Council salary funded from Tax Operating Contingency reserve | (124,673) | (0.04%) |

| Bill 109 impacts | 829,580 | 0.30% |

| Bill 109 portion funded from Tax Operating Contingency reserve | (556,000) | (0.20%) |

| Total in-year Council approvals | 273,580 | 0.10% |

Legislated changes

| Legislated changes | 2023 confirmed levy requirement ($) | 2023 confirmed levy impact |

|---|---|---|

| Ontario Municipal Employees’ Retirement System (OMERS) employee eligibility adjustment | 980,000 | 0.35% |

| OMERS employee eligibility adjustment funded from Compensation Contingency reserve | (980,000) | 0.35% |

| Bill 23 impacts | 1,000,000 | 0.36% |

| Bill 23 portion funded from Tax Operating Contingency Reserve | (500,000) | (0.18%) |

| Total legislated changes | 500,000 | 0.17% |

Other 2023 updates

| Other 2023 updates | 2023 confirmed levy requirement ($) | 2023 confirmed levy impact |

|---|---|---|

| Investment in Paramedic Services resources (using provincial COVID funding for paramedics) | 0 | 0.00% |

| Phase-in of South End Community Centre over additional year | (69,000) | 0.02% |

| Phase-in of Baker District Redevelopment over additional year | (400,000) | 0.14% |

| Non-union Municipal Employee (NUME) compensation adjustment | 90,310 | 0.03% |

| NUME compensation adjustment funded from the Compensation Contingency reserve | (90,310) | (0.03%) |

| Offset transfer to Affordable Housing Reserve by the Tax Operating Contingency Reserve | (500,000) | (0.18%) |

| Kids Ride Free pilot program extension | 138,911 | 0.05% |

| Kids Ride Free pilot program funded from Tax Operating Contingency Reserve | (138,911) | (0.05%) |

| Adoption of the Affordable Bus Pass sliding scale on an ongoing basis | 458,000 | 0.16% |

| One-time capital investment related to Affordable Bus Pass sliding scale | 100,000 | 0.04% |

| Adoption of the Affordable Bus Pass sliding scale and associated one-time capital investment funded from the Tax Operating Contingency Reserve | (558,000) | (0.20%) |

| Annual contribution to the Welcoming Streets initiative | 202,500 | 0.07% |

| Funding for Business Service Agencies Agreements | 300,000 | 0.11 |

| One-time investment in resources to address urgent homelessness, additions and mental health crisis | 150,000 | 0.05% |

| One-time investment in resources to address urgent homelessness, addictions and mental health crisis funded from the Tax Operating Contingency Reserve | (150,000) | (0.05%) |

| Reduction of the Infrastructure Renewal transfer | (1,400,000) | (0.50%) |

| Total other 2023 updates | (1,866,500) | (0.67%) |

2023 increase in net payments in lieu and property taxes to be levied

| 2023 increase in net payments in lieu and property taxes to be levied | 2023 confirmed levy requirement ($) | 2023 confirmed levy impact |

|---|---|---|

| Total 2023 property tax levy and payment in lieu of taxes required | 295,882,530 | n/a |

| 2023 increase in property tax and payments in lieu of taxes to be levied | 16,163,304 | 5.78% |

| Less assessment growth | (3,685,000) | (1.32%) |

| Total property tax levy | n/a | 4.46% |

2023 confirmed user rates

| Legislative impacts | 2023 confirmed gross expenditures | 2023 confirmed user rate impact |

|---|---|---|

| 2023 approved budget increase | 2,517,346 | 2.73% |

| Bill 23 impacts: water | 300,000 | 0.33% |

| Bill 23 impacts: wastewater | 300,000 | 0.33% |

| Bill 23 impacts: funded from transfer from rate-specific contingency reserves to rate-specific capital reserves | (600,000) | (0.66%) |

| Non-union Municipal Employee (NUME) compensation adjustment (non-tax) | 12,560 | 0.01% |

| NUME compensation adjustment funded from rate-specific contingency reserves | (12,560) | (0.01%) |

| Total confirmed budget | 2,517,346 | 2.73% |

Capital prioritization process

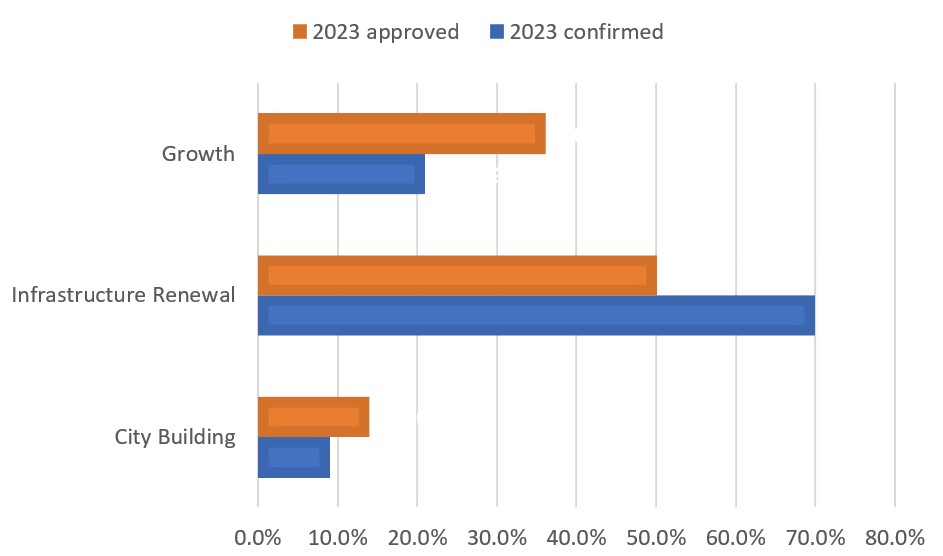

In response to high inflation impacting the City’s ability to deliver capital projects within their approved budgets, Council approved providing staff delegated authority to prioritize capital projects within the current approved capital expenditures budget until the approval of the 2024 capital budget.

A holistic review of the approved budgets was undertaken by staff in alignment with the prioritization criteria identified in the Inflationary Financial Impact Strategy report, to create financial capacity to deal with inflationary pressures. The capital prioritization process resulted in a $38.8 million net decrease to the approved 2023 capital budget, resulting in a confirmed 2023 capital budget update of $123.2 million.

2023 confirmed gross capital expenditures and funding sources ($ thousands)

| Funding source | 2023 approved budget | 2023 confirmed budget |

|---|---|---|

| Grants and subsidies | 23,675.0 | 17,323.0 |

| Development charges | 36,480.8 | 15,788.4 |

| Rate funding | 49,717.2 | 41,738.4 |

| Tax-funded | 51,152.0 | 47,245.6 |

| Other | 882.0 | 1,060.0 |

| Total capital funding | 161,907.2 | 123,155.5 |

After the capital prioritization, the confirmed 2023 capital budget is now comprised of 70% infrastructure renewal (previously 64%), 21% growth (previously 25%), and 9% city building (previously 11%).

| Item | 2023 approved | 2023 update |

|---|---|---|

| Growth | 36.0% | 21.0% |

| Infrastructure Renewal | 50.0% | 70.0% |

| City Building | 14.0% | 9.0% |

2023 Capital prioritization adjustments by funding type ($ thousands)

| Funding type | 2023 approved budget | 2023 confirmed budget | 2023 budget adjustment |

|---|---|---|---|

| City Building | 22,398.4 | 10,990.4 | (11,408.0) |

| Growth | 57,156.8 | 25,405.8 | (31,751.0) |

| Infrastructure Renewal | 82,352.0 | 86,759.3 | 4,407.3 |

| Grand total | 161,907.2 | 123,155.5 | (38,751.7) |

2023 Capital prioritization outcome by strategic plan pillar ($ thousands)

| Strategic plan pillar | 2023 approved capital budget | Capital prioritization adjustment | 2023 confirmed capital budget |

|---|---|---|---|

| Building our future | 24,244.8 | 13,129.0 | 37,373.8 |

| Navigating our future | 48,011.1 | (21,507.1) | 26,504.0 |

| Powering our future | 1,150.0 | (1,150.0) | 0 |

| Sustaining our future | 83,949.3 | (31,669.6) | 52,279.7 |

| Working together for our future | 4,552.0 | 2,446.0 | 6,998.0 |

| Grand total | 161,907.2 | (38,751.7) | 123,155.5 |

2023 confirmed total budget summary

Total operating and capital expenditures by pillar ($ thousands)

| Pillar | Operating expenditures | Capital expenditures | Total gross expenditures |

|---|---|---|---|

| Building our future | 267,632.9 | 37,373.8 | 305,006.7 |

| Navigating our future | 46,460.4 | 26,504.0 | 72,964.4 |

| Powering our future | 17,729.1 | 0 | 17,729.1 |

| Sustaining our future | 133,231.2 | 52,279.7 | 185,510.9 |

| Working together for our future | 44,098.6 | 6,998.0 | 51,096.6 |

| Gross expenditures | 509,152.1 | 123,155.5 | 632.307.6 |